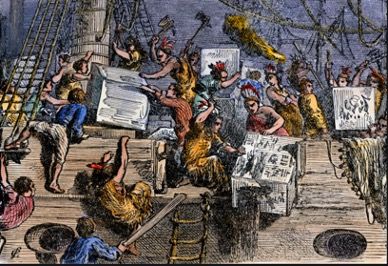

247 years ago, on December 16, 1773, one of the most infamous

American political events took place: the Boston Tea Party. On that night so

many winters ago, a large group of colonists led by Sam Adams and John Hancock,

having had enough of the taxes imposed by the British, decided to take the tea

from the holds of three ships recently arrived from China and throw it all into

the Boston harbor. The Dartmouth, the Beaver and the Eleanor were all loaded to

the gills with tea. A group of around one-hundred Sons of Liberty dressed themselves

in native garb and boarded the ships. When imagining dumping tea chests into

the harbor, I normally picture some "normal" sized chests, maybe the size of

footlockers, going overboard to bob the night away in the cold water. In fact,

however, according to History

magazine, the total volume of tea dumped over the course of three hours that

night was 45 tons! I'm guessing the chests were larger than I had been

picturing.

Experts on the topic say that the tea that was destroyed

that night would have a market value of over 1 million dollars today. It would not, however, have been enough tea to

turn the harbor into a satisfying brew, even if the water had been much warmer.

You can read a fun, related analysis here.

As is usual with these historical founding tales, there is a

less-well-known backstory. It turns out that some of the leaders of the Sons of

Liberty—namely the aforementioned Adams and Hancock—also presided over very

profitable tea smuggling operations. So yes, while they were indeed fighting

against taxation without representation, they also had a financial interest in

the price of tea. Which motivation dominated? I will leave to your meditation.

If any readers from the Boston area can give us some more local details, we may

learn more.

This event had major repercussions. King George and Parliament

were "not amused." The harbor was closed until the ruined tea was paid for, and

other responses, known as the Coercive Acts, were imposed, including martial

law. Many historians say that in this way, the tea party lit the flame of the

movement towards complete independence from Britain. At the time, however, many

notable colonials decried the destruction of private property (including George

Washington).

So, we are at the anniversary of this important American historical event, but how am I ever going to tie that into investing?

This headline from Bloomberg got me to thinking about the

taxation without representation that goes on every day via the Government Sponsored

Entities, or GSEs:

"GSE trading increased to $3.8b

yesterday from $3b the previous session, according to TRACE. The previous

Tuesday saw $4b, and the average volume over the last 10 Tuesdays when the

market was open is $4.7b."

The vast majority of this volume of GSE bonds being traded can

be described as callable agency debentures, and right now, they should be thrown

into the harbor, just like the tea.

What? I'll get to that, but first, let us take a step back.

Why do GSEs even exist? The first one, the Federal Loan Bank, was created in

1916 to assist banks in creating farm credit. A noble purpose, no doubt. Later

came Fannie Mae and Freddie Mac, who helped provide liquidity to the housing debt

market, and later still Sallie Mae, who likewise provided liquidity for student

loans. Another critical cooperative GSE known as the Federal Home Loan Bank

system was created to assist banks with lending facilities and to help

coordinate the operational portion of Fannie and Freddie's mission. The FHLBs

are actually owned by their members, and no one can deny that they are now a

critical component of the banking system in the United States. As near as I can

divine, all of these GSEs were intended to be "for profit" entities, and the innovation

of pooling assets and reselling them into the market place with a quasi-governmental

guarantee has revolutionized banking and investing in the United States (and

arguably in all advanced economies).

So, if they have revolutionized banking across the globe,

why would I want to throw their securities into the harbor? Seems a bit of a

leap. And I should add that it's not all

of their securities that need to go overboard—it's their direct debt (their debentures)

and specifically those debentures with imbedded options.

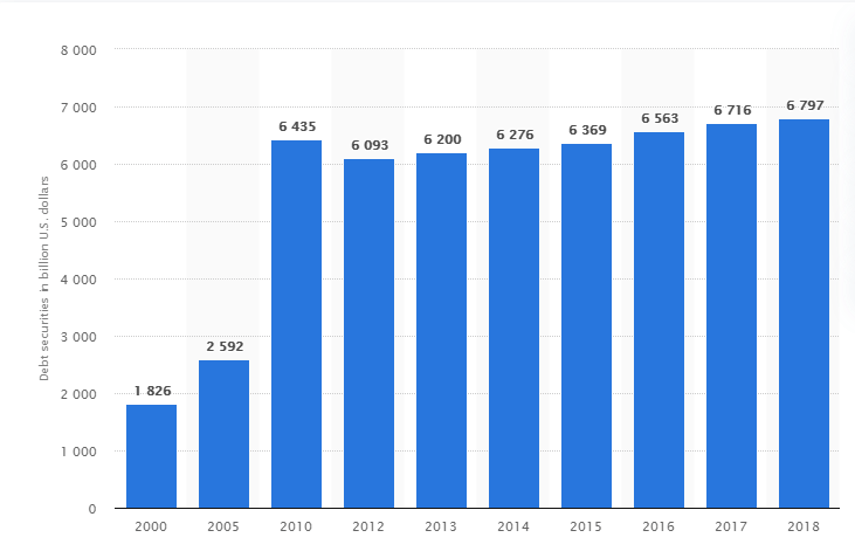

As you can see in the Statista graph below, the amount of

debt issued by the GSEs has nearly quadrupled over the last decade. Sadly, much

of this has included imbedded call options.

Banks and credit unions across the United States are very

active participants in this space and, as we have discussed before, they are

therefore in aggregate short massive amounts of call options.

Take a moment to consider why this has happened. Who

benefits?

First, we must remember that the bonds being issued by the

GSEs are their liabilities.

Second, we must remember that the GSEs are for-profit entities.

They do not make specific transactions (like issuing callable bonds over more

bullet bonds) unless they believe them to be profitable for them.

Third, the GSEs must "pay" the broker-dealers who distribute

their debentures, by delivering the securities at a discount to the

underwriters, much like a bank issues CDs through brokers at a face discount.

Fourth, as the FINRA website accurately describes these

bonds' call risk:

"Many agency securities—step-ups in

particular—carry call provisions that allow the issuer to pay you prior to the

bond's maturity date, typically when interest rates drop, leaving you to

reinvest at lower prevailing rates."

When we combine the facts above, we can see why and how the purchasers

of this debt are intentionally left holding the bag. Not only have they

provided the agencies with a repriceable liability portfolio which has been

resetting down to lower and lower rates over the past 10-15 years (and will not

symmetrically rise if rates climb until their issues mature), these investors

have provided this at an unfairly low price. The brokers selling these

securities have recycled the trade, over and over again. Many brokers would rather

place a callable bond in a client's portfolio simply because it comes with a

good likelihood of creating a new transaction opportunity prior to maturity.

Why do I say unfairly low price? Today, this has reached

unbelievable levels.

7-year maturities with a 1-year

call at a yield of 0.80%...on the same day a non-callable 7 year was issued at

the same rate!

5-year maturities with a 1-year call at a yield of 0.52%

I could go on and on. These bonds are trading at almost the

exact same yields as the underlying, non-callable bullet agencies of the same

maturities. Many of them trade a spread of less than 5 bps. In short, these

options are being "sold" by investors who buy the bonds for almost nothing—in

some cases, for exactly nothing.

The two other parties to this deal—the agencies and the

brokers—get virtually free option value for the future, to reprice their

liabilities (agencies) or the chance to sell early replacements (brokers).

Sometimes, I feel like I'm ranting like a lunatic, but I'm

always hopeful that some new Sons of Liberty will rise up and smash today's allegorical

tea chests.

Speaking of rants, who can forget the famous Jim Cramer rant of

2008? Shortcut to the 1:40 mark!

Please understand this: I am not categorically opposed to

owning bonds with imbedded short option positions, that is, bonds that can be

called or prepaid. But I only want to consider that when the reward for the

short option risk is attractive enough.

Today, it is nowhere near enough. I just can't get that voice out of my head

screaming at me: Don't sell cheap options!

Final, final thought: We have all seen the footage of the

nurses and other front line health workers getting vaccinated. I'm so thankful

for their sacrifice, risk-acceptance, and hard work. They are amazing heroes.

For the first time in ten months, it feels like there is a light at the end of

the tunnel.