In 1979, the Charlie Daniels Band released what was destined

to be their top seller of all time. The classic 3 minutes and 34 seconds of

raucous fiddle playing has sold well over 4 million copies since it was

released over 40 years ago. At the time of the release, its lyrics included profanity

and was considered extremely graphic…ah, a simpler time!

The song takes us through a fast-paced story of the devil

going to Georgia lookin' for a soul to steal. He makes a deal with a local

youth Johnny to compete for a golden fiddle. If Johnny loses the bet, he loses his soul. It doesn't seem like a deal

that I would want to make. Particularly, since I can't play the fiddle! But generally, no one in their right mind

would make that kind of outsized bet against the devil.

I thought that maxim was fairly obvious until I saw what

happened last week. For those of you who have attended one or more of our

hundreds of programs over the last 25 years, you know that we prefer to let the

numbers do the talking. One of the most popular teaching sections is what we

call "Live Callable".In it, we actually

take out our calculators together and as a class run the numbers on a "live"

offering."Live" is a bit of a misnomer,

since it is usually 2-3 days old, but you get the idea. Just last week, I was

doing this with a virtual class and something truly amazing happened.

Let me set the stage for you.

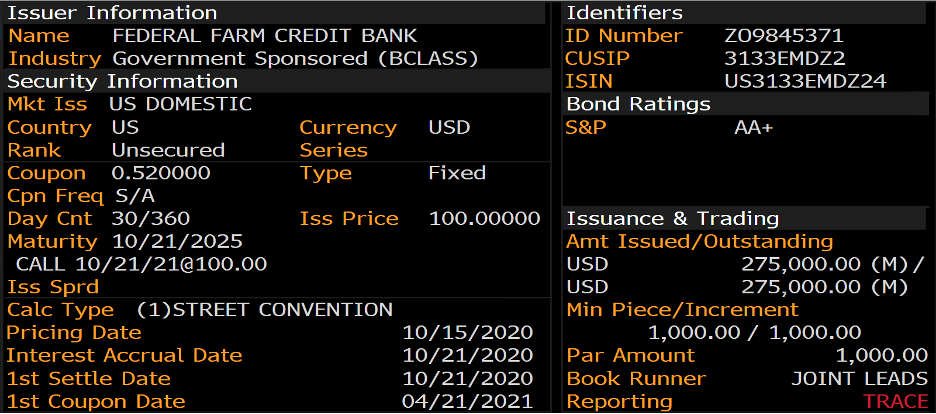

On October 15, 2020, the Federal Farm Credit Banks Funding Corporation (let's call it the FFCB) issued 275,000,000 of a bond through the normal channels. It was underwritten by a consortium of dealers. The structure of the bond is a 5-year non-call 1. For those of you less familiar with market jargon, this means that the bond has a maturity in 5 years, but is callable just 1 year after issuance. The coupon on the bond is 0.52%. As always, I like to put hard numbers on things instead of statistics, so for clarity, that means an investor would receive $5,200 in interest income for every 1 million dollars invested. Since in future years, the rest of my story may be hard to believe, for the historical record, I am including a description page from Bloomberg with all of the issuance information listed. This is, of course, public information.

Before I continue, I want to make sure we are all clear,

definition-wise, on what exactly a call option is.

A call option is the

right, but not the obligation, to buy an asset at a future time and price. This

means that the person selling a call option will contractually have to sell the

asset involved at the designated time and price at the option owner's behest.

In this case, the underlying asset is the five-year agency

debenture and the buyer of the security is simultaneously selling an option that

will empower someone else to buy the debenture away from him at a price no

higher than par. The call is continuous, and a de facto consequence of this is that the bond will never be able to

trade above par after the first call date (one year hence, in this case) passes

or, in practice, even prior to that as the first call date approaches.

Now, on the same day that this bond was offered at a yield

of 0.52%, an effectively identical underlying five-year debenture, without an

attached call option (aka a bullet), was available at the slightly lower yield

of 0.45%.

This means the buyer of the callable bond sold away his

rights to hold onto this investment past one year for a miserly 0.07%, or $700

per million.

I need to digress for a minute.

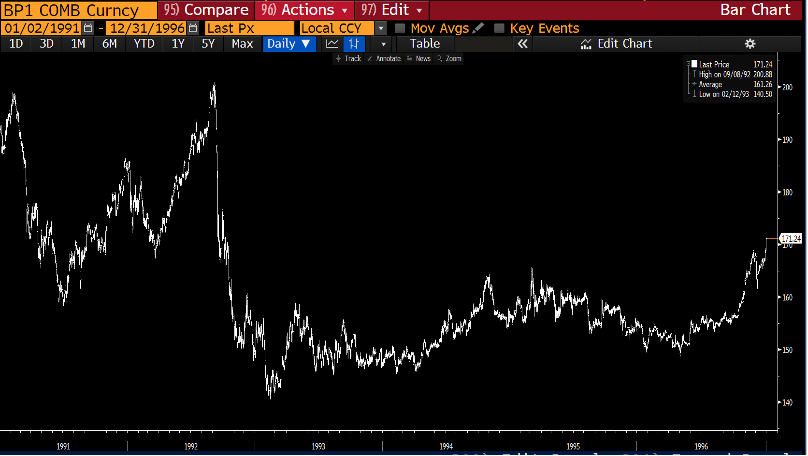

One of my most memorable trades at the Chicago Mercantile

exchange was in the British Pound pit.

It was around the time period when George Soros was attempting to break

the pound. In 1991, the British Pound was in trouble. They had pegged their

currency to the newly established European Exchange Rate Mechanism and had

vowed to keep the Pound within a certain band connected to the German Mark. It

was doomed to fail and, in the summer of 1992, Soros began building up a

massive short position in the pound via both the cash markets and the futures

pits in Chicago. On September 16, 1992, the British government essentially

admitted defeat and allowed their currency to float freely. The pound dropped

somewhere in the neighborhood of 25% (!!) against the US dollar over a very

short time frame. Most people have probably forgotten about this situation,

which is widely considered one of Soros' greatest trades. But I never will.

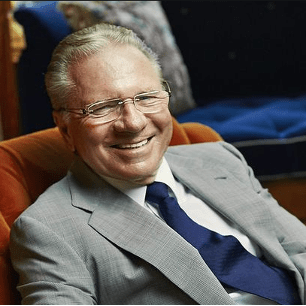

Why won't I forget it? Because I made one of my own largest

trades during that time selling "way out-of-the-money" puts. They were "cheap"

options that I hoped would expire worthlessly. Keep in mind, I was a young 25-year-old

trader and I thought it was pretty cool to book a "big" trade. The cool factor

did not last long, because as soon as I entered the trade into our system (we

had touch very sensitive, primitive screens way back then) I got a call from

our owner Thomas Peterfy, a feisty Hungarian. See his smiling face? I can

assure you that he was not smiling when he called me. Side note: Mr. Peterfy

eventually founded Interactive Brokers, one of the largest online broker

platforms in the world.

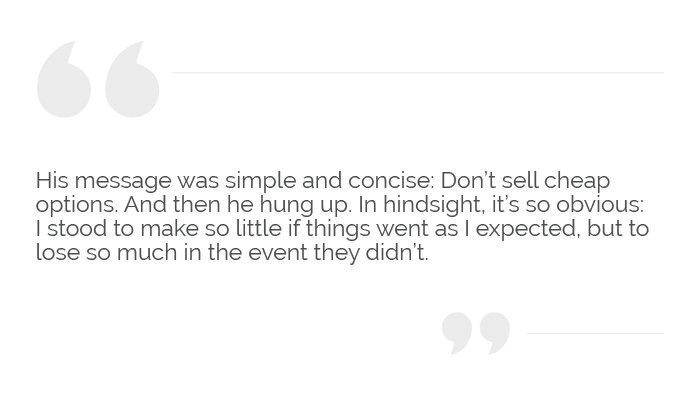

His message was simple and concise: Don't sell cheap

options. And then he hung up. Simple advice. But to a young gun standing in the

pit having just made the error, it was monumental. In hindsight, it's so

obvious: I stood to make so little if things went as I expected, but to lose so

much in the event they didn't. See my post entitled Gamma Trap

for more on this idea.

Back to the bond in question.

Selling an option on a 5-year security for seven basis

points is the very definition of selling an option cheaply. It also happens to

tie into my intro. True, Federal Farm Credit is not the Devil, but you are literally

selling your soul—and any upside opportunity—for a measly $700/million. As you

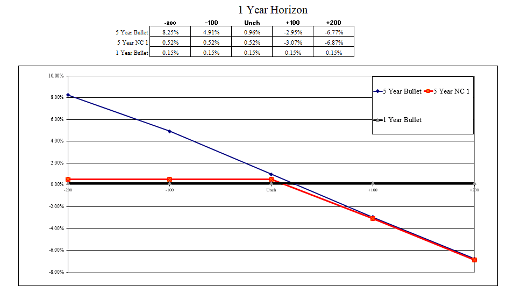

know, I love to look at a variety of scenarios, over time, and count and then

compare the money. When I ran the numbers last week (in a live class setting,

mind you) I almost could not believe it. I am going to represent the outcomes

in a graphic form so it is easier to digest. For the first time in the 20+

years of running these numbers live—the callable bond wins nowhere on the graph.

Why? People are selling cheap options. If rates go up just

1% over the next 12 months, the $700 of extra income will be dwarfed by the

~$35,635 in unrealized loss I will be stuck with. For rates up 200, it will be

over $72,000. And don't forget—the maximum gain (over the $5,200 in interest

income) you can have in 1 year is $0 because the price of the bond cannot

appreciate in an open call window. Nothing, nada, zilch.

At the end of the song after Johnny

has won his bet with the Devil, the lyrics tell us:

"The

Devil bowed his head, because he knew that he'd been beat.

And he laid that golden fiddle on the ground at

Johnny's feet.

Johnny said, "Devil, just come on back if

you ever wanna try again,

'Cause I've told you once--you son of a b***hh--I'm

the best there's ever been."

Unfortunately,

if you are making the bet above, you won't win the golden fiddle. For a million

dollars invested, $700 in income is not a golden fiddle. And on a total return

basis, when we count the fact that the call option prevents you from enjoying

an even modest gain in the value of the underlying debenture, you don't even

really "win" that. Don't be tempted into it…just don't.

Final,

final thought: I could care less about the Dodgers or the Tampa Bay Rays, but

it is so great in this year to be watching World Series baseball! And to see real

fans in the stands. Play ball!

Be sure to fill out the form below to subscribe to my weekly blog.