Here is a chance to really impress your friends and family with a little-used Latin phrase which roughly means: -Appearances are deceptive. You may wonder how I found this term; I came across it while looking for some stocking stuffers at this very cool website: www.Theory11.com. This site not only helped me with my shopping needs but also got me thinking about their motto, the title of this blog. Theory 11's main products are cards and magic tricks.

These

characteristics were central to a court ruling on gambling online. In this case,

a judge noted that there are four basic types of games one could play online. I

want to take a moment to go through his logic and then connect the ruling to

the world of investing.

The first category of games can be described as games of

chance, where the participants have no ability to influence the outcome. The

appeal of these lottery-style games is odd to me, since you can actually look

up the expected outcomes for participating and see that they are universally

negative expectations, but people still love to play them nonetheless. This enthusiasm

is due to the literally "one in a million" shot of winning the big one. In the

case of Illinois' Lotto, the chance of winning the jackpot is actually

1:20,358,520…but after one-in-a-million, who is actually counting?

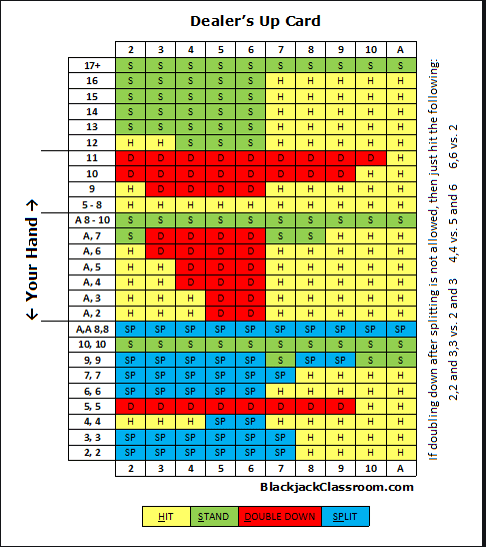

The judge's second category are games based mostly on luck,

but some modicum of skill influences the result. An example of this category is

blackjack. In blackjack, we are dealing with a known number of cards and

attempting to get closer to 21 than the dealer without going over. The dealer

is constrained by a set of rules telling them when they must or must not "hit,"

or take another card. In addition, the "player" also gets to see one of the

dealer's first two cards. The odds for any visible situation in this game can

actually be calculated and the "correct" play ("hit" or "stay") can be

established. In fact, most casinos allow you to reference a strategy chart like

the one below.

However, even if you followed the chart exactly, you would

still have a slightly negative expected outcome. Depending on the exact house

rules (e.g., the number of decks) the house "edge" can get as low as 0.5%.

Luckily for the casinos, they know that most people tend to play with their

hearts and not always their heads (plus, of course, there are occasionally

cocktails involved). Most estimates are that over the course of time, against a

fairly good player, the casino will still have somewhere between a 2-4% edge

over the player. So, you can see that while there is skill involved, at the end

of the day - to win - you will also need some luck.

The third category contains the games where there is more

skill at play than luck. This was the most important category for the judge's actual,

real-world ruling. The case before the court was a "home" game of poker. This

game was organized by an enterprising homeowner and included professional

dealers, but did not have an official "rake" whereby the players had to pay for

every hand. Rather, the players were expected to tip the dealers, the homeowner,

and yes, the cocktail waitress. The homeowner, Mr. Dent, was charged with

running an unlicensed gambling establishment. His lawyer argued that, in fact,

poker is not gambling.

In his ruling on Commonwealth

v. Dent, Judge Thomas James observed that:

"There are over 600 books on the subject of poker strategy

and they all agree that poker is a game of skill. He quoted Mike Caro's

book Secrets of Winning Poker: "money flows from the bad

players to the good players." He also cited "a number of mathematical

studies that link 'poker and economics.'" One study in particular showed

that "Beginning poker players rely on big hands and lucky draws. Expert

poker players use their skill to minimize their losses on their bad hands and

maximize their profits on their big hands."

My experience agrees with the judge,

because I am not a skilled player, and therefore I usually lose! However, in order to make sure that home-based

poker games would not be allowed to go untaxed, the state of Pennsylvania

overturned the ruling.

We can have this debate sometime in the

future, but I think we can all agree that ultimately, really skilled poker players

will usually win (especially if they have deep pockets!). This "skill" is where

the title to this blog really comes from. The really great players have the

ability to make use of deceptive appearances on both good and bad hands. As the judge noted in his ruling:

"Poker is the one and only [card] game where a skilled player

may hold bad cards for hours and still win the money."

The fourth and final category were games

where skill dominated any luck factor in determining the result. This category

included chess and bridge, where highly skilled players should always beat novices. You have probably heard about the amazing

ability of chess grandmasters beating a whole room of good to very good

players. This young man (Rameshbabu

Praggnanandhaa) was able to beat all 20 of his opponents at once!

Side note: Rameshbabu is also the world record holder

for becoming the second youngest chess Grandmaster ever, at the ripe old age of

12 years, 10 months and 14 days, barely falling "short" of Sergey Karjakin (12

years, 7 months). For more info - check

out this article.

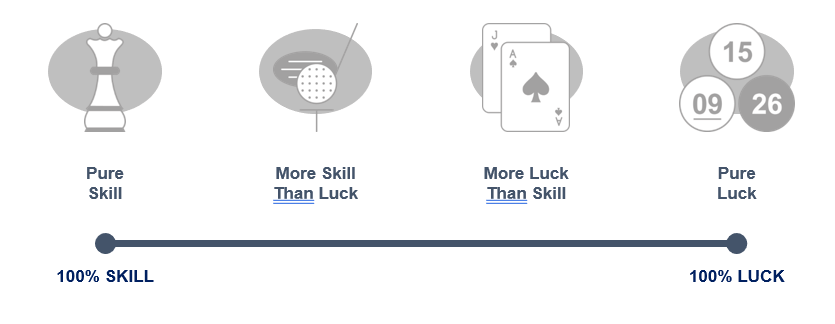

Ok, so that's all interesting info and

the judge's ruling is definitely insightful, but what does it have to do with

investing? I have used this analogy for years, because it applies almost

perfectly, but before I discuss applications, take a look at this graphic and

tell me where YOU fall on the continuum between luck and skill as an investor.

Be honest with yourself.

Now for the more important question:

Where should you be? Is investing like chess? Is there actually

the potential to be a pure "skill" player, or will there always be some element

of luck? Are there market participants who are operating on the "pure luck" end

of the spectrum, basically just throwing up their hands in frustration and saying,

"Sometimes you win, and sometimes you lose?"

Your answer may depend on which markets

you participate in. For example, I think there may be a fair number of people

who feel that they got lucky buying TSLA, AMZN, APPL, GOOG, etc. When dealing

with stocks, there are extreme unknowns: earnings, PE ratio and market momentum,

to name just a few. These are not really

knowable so assuming these investors rely on a healthy dose of luck is probably

fair. But probably not just a lottery play, either. Category Two, perhaps?

But let's think about fixed income for a

minute. In fixed income, we have a much more constrained fact set. As I

discussed last week, there are still unknowns - for example, the prepayment

speeds affecting MBS - but there are many more "knowns." Category Three, at

least? There are rational assumptions that can be made to represent different reasonable

scenarios and over time which can help us become a much more skilled

"player". The great news about fixed

income is that you can practice to learn and improve your skills. You may never

become as good as Rameshbabu is at playing chess (maybe only because chess is

Category Four, right?), but you can certainly avoid playing the "game" as

though it were just a lottery.

Over the next couple weeks, I plan on

covering some of these "skill" topics in a little more depth. Consider it my

Christmas present to you! And yes, it might feel worse than a lump of coal, but

in practicality, I hope it is at least like a pair of socks - maybe not so much

fun, but of actual value in your life!

Final, final thought: It is hard to beat, or resist, a well-made

Christmas cookie. Especially if it's shaped and decorated into something

Christmas-y. Curiously, I always reach for the green-sugared "bell."