Some of you will recognize the title from The Godfather.

The scene begins with Michael Corleone killing both a mob boss and a police

captain in a little Italian restaurant. The act sets off a crackdown on mob

violence from the police department but also causes an internecine battle

between the five mob families of the greater New York area. What does "Going to

the Mattresses" mean? It means you lay low for a while until the storm passes.

The whole crew moves into apartments run by "the family". They make spaghetti,

play the piano, and basically do nothing for a couple of months.

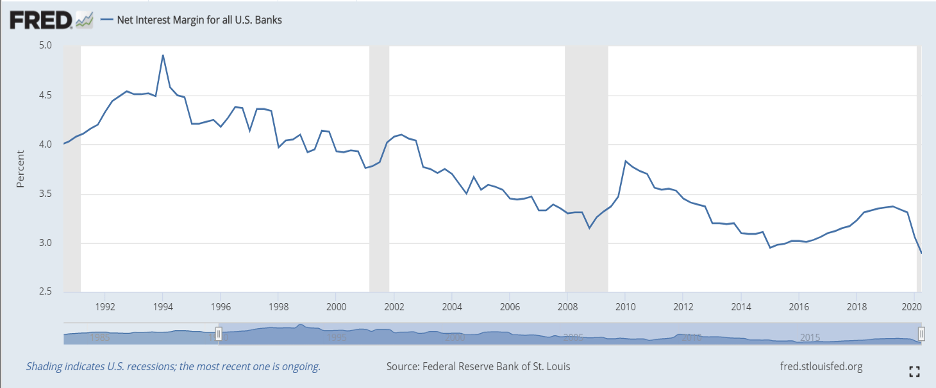

Banking is in a storm right now. No doubt. Check out the

most recently updated graph on Net Interest Margin from the Fed St. Louis.

The last reading is from the 2nd quarter of 2020.

It is 2.89%. If I were a betting man, I would bet that the 3rd a quarter will be lower. Actually, if you know me, you know I am a betting man,

but not on things like this.

Most talking heads focus their yapping on the yield of the 10-year

spot on the Treasury curve. It's an interesting talking point I guess but most

community-based financial activity takes place well inside that time frame,

more like 3-5 years. When I look at the history of the 3 year since the

pandemic set in, I see a grinding trade. The "high" point for the 3 year since

March was set on April 7th at a miserable 0.36% and the low was on

August 4th at 0.10%. In my former life as a trader, we called it a

grinding trade, because it grinds the life out of you. It's slow, boring, and

painful. Granted, most people aren't portfolioing lots of 3-year Treasuries, so

I asked my mortgage experts where all of the production is coming out of the

agencies and it turns out that in the world of 30-year mortgages the most popular

coupon this month is a 2% pass-through (WAC = 2.91). So, in layman's terms, you

can buy a 30-year pool, with an average life of just over 5 years, at a price

of 103-16/32's and get an expected yield of about 1.25%. Or, if that seems a

little unbelievable (and it should), you can go into the most popular 15-year

cohort. It also has a 2% coupon. For this product, you would pay around 104 for

the 4-ish year average life and hope to book a yield around 0.95%.

The thing about going to the mattresses is this: Business

must go on. Granted, in The Godfather the business depicted is a little

sketchier than banking, but you see my point. Just because we are grinding away

at the millstone, you must remain strong to survive.

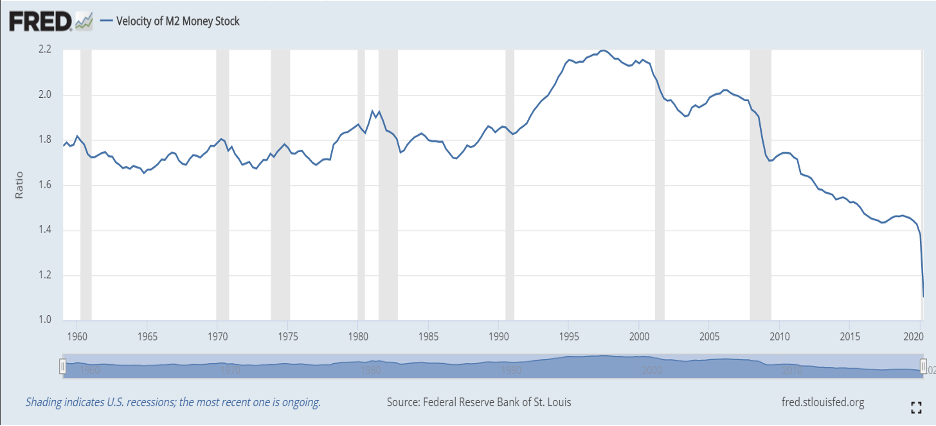

Let me switch gears on you slightly and discuss some of the

reasons for "the grind". I really believe that the first thing we should all be

watching is the velocity of money. For anyone involved in finance, this is

critically important. It tells us how fast and free the blood of our economy—namely

money—is flowing through the system. It's one of the four key variables

identified by economists throughout history in the classic formula M x V = P x

Q (The Equation of Exchange). It's also the least discussed and least observed.

Sometimes I feel like Don Quixote shouting from the rooftops (or was it

windmills?), exhorting the world to watch the velocity of money, only to be

ignored. This graph sends chills down my

spine.

This is directly related to the massive increase in money

supply (M). The Fed is trying to pump up both the P and Q (Prices and Output)

by force-feeding the economy buckets of cash. It's not working. For some

perspective, consider that in Q3 of 2010 the "M2 Money Stock" was around 9

trillion dollars. Over the past decade, that number has doubled to 18 trillion

dollars (reminder: a trillion has twelve zeroes).

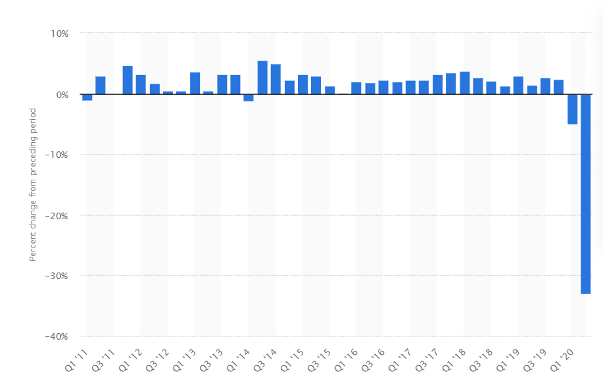

What about the other side of the equation? It's a very logical question and it's not very pretty. Let's first take a peek at GDP ("Q" in the formula). I wanted to find a graphic that takes the raw numbers and makes a visual impact and I think Statista has done a fine job. Check this out:

Quarterly Growth of the Real GDP in the United States from

2011-2020

The last reading is again from the 2nd quarter,

and it comes in at a stunning negative 32.9%.

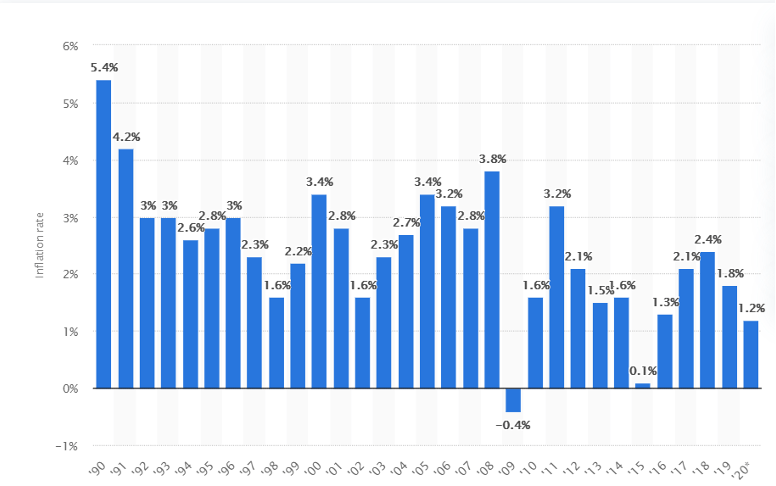

And just to complete our equation, here is the inflation rate

("P") for the last 20 years:

United States Inflation Rate from 1990 to 2020

Sorry for all the graphs, but I think it's important to

think about all four variables as we move forward.

To summarize:

- M is massively higher

- V is massively lower

- P is moderately lower

- Q is massively lower

If you are a reader of this blog, I imagine you have had some math in your background, so you know something has got to give to keep an equation in balance. Sadly, as we have discussed at length in previous posts, we just don't know which factor will give. We do know that the Fed seemingly has the ability to print money ad infinitum, so perhaps we can rule out a big decrease in money supply. (Note: In my somewhat limited studies of money supply, it has never gone down YOY in recorded history. Rather, it's just the rate of growth that rises or falls). V is actually solved via the other three parts of the equation: It's the output, really. This leaves only the two variables of GDP and inflation, both of which are critical. It seems that in the final analysis, one or both of them will have to balloon. I sure hope it's GDP!

As investors, we have to go to the mattresses. This is not

the moment to be a hero. But there is still work to do.

One of the maneuvers we have seen many community banks

executing is the issuance of sub-debt at these historically low rates. I quoted

Gary Svec in my August 18th post entitled The Pack. Here is

the quote again in case you missed it:

"In these unique times, issuing sub-debt

enhances capital at a time of great uncertainty and, by investing in the sub-debt

of other conservative banks, the industry retains the interest paid on that sub-debt

at a time when good yielding assets are hard to find and net interest margin is

under pressure. Furthermore, no one has ever been criticized for having too

much capital during times of great uncertainty…or great stress."

Back to The Godfather: While the Corleone family and

the other families were laying low and staying out of trouble, one family was working

hard at reorganizing, ultimately coming out stronger. Banks that do the hard

work during this "grind" will come out stronger, more efficient, more

successful on the other side. Right now, we have to do more than just make

spaghetti and play the piano.

Final, final thought: We had almost 900 attendees at our

virtual Advanced Course last week. Technology is an amazing thing and this never

would have happened a year ago. Times are changing, seemingly faster every day.

Be sure to fill out the form below to subscribe to my weekly blog.