Many of us have been binge-watching shows on various media

outlets lately. I have gotten hooked on a show called Hell's Kitchen for

two main reasons: I am a huge Gordon Ramsay fan, and I love food. The basic

idea of this show is that it starts with around 15 chefs and eliminates them

until there is one winner. There are tons of twists and turns. Some of the

chefs are very good, and some of them are really bad. The competition is fierce.

At the end of each episode, one of the participants is axed. The participants

have some say in that process, but the ultimate decision comes down to Chef

Ramsay, and he is brutal.

I am fascinated by two contending aspects of the show.

- Gordon Ramsay is actually a very generous and nice man. I have watched his cooking shows on Master Class and he comes across as charming. I believe he is a gifted teacher who loves teaching people to cook. But on this show, he turns into a real jerk. He screams at the cooks and belittles and mocks them. It's really quite amazing. I mean, I know that the participants sign up for the show knowing it's going to be tough, but wow.

- It is all about process. Throughout the many trials and tribulations that the cooks face, there is always a process. How do you cook the salmon, risotto, and beef Wellington? Mistakes and failures are not accepted; that's when the screaming begins. All you have to do is execute perfectly every time and you will win the prize. It's that simple—and it's that impossible. When the participants let their emotions get the best of them, all "hell" breaks loose.

Of course, there is also the gamesmanship, backstabbing, and

strategic gambits that make the show great. Try it out. If you can find the uncensored

version, watch that one. Just don't have your kids in the room!

Since I love to cook (and, unfortunately, to eat!), the show

is extra intriguing to me. The contestants have to master three appetizers, three

entrees, and three desserts and then execute them over and over again, to

perfection. However, when you have Gordon Ramsey screaming in your face, very

little sleep, and all kinds of weird twists and turns, mistakes happen. Emotion

and fear start to kick in.

So how is this show like investing the financial markets or banking?

In surprisingly many ways.

In our world, we are also involved in an incredibly

fascinating game. I, for one, am just as driven to win this game as are my

favorites competing on Hell's Kitchen. In this "game," there are also

two contending aspects.

- The markets are organized and, at least in the U.S., highly regulated. The vast majority of banks, having fought through the crises of the last 20 years, are almost by definition skilled operators. They "know their way around the kitchen." The shareholders and participants in your organizations have, for the most part, done extremely well. I have been in so many bank and credit union lobbies around this country that I can't even count them. Rarely have I met with a CEO or CFO and came away thinking "these people have no idea what they are doing," although it has happened. After the past two decades, clueless organizations have gone out of existence. Eliminated.

- It is all about process. Despite the many market changes over the last 20 years in the banking industry, the best processes have not changed. One of my incredible mentors over the past 25 years has been Phil Nussbaum, co-founder and Chairman of Performance Trust. His philosophy is so simple: Make good risk/reward decisions, avoid poor risk/reward decisions, and make these decisions with a mind to how they act in combination with each other on both sides of the balance sheet. If you follow these three simple rules, all you then have to do is execute. Execute, every single time. So simple—and yet, so difficult.

Let's reflect briefly on the history of banking in The United States. There have been many twists and turns in the environment over just

the last 30 years. In the 80s, there was the savings and loan crisis, which was

arguably the most catastrophic period in the history of banking since the Great

Depression.More than 1,000 banks across

the country failed in a very short period of time. Then, just before I started

in the banking industry in 1995, the events of 1994 happened. That is now more

than a quarter of a century ago. I think many people today forget that in 1992

we hit new lows when Fed Funds dropped to 3%. Keep in mind that this was coming

down from 9.75% in 1989. Then, from December of 1993 to March of 1994, Fed

Funds went from 3% to 6%. That's just 90 days. That is rates up 300bps in a

quarter.

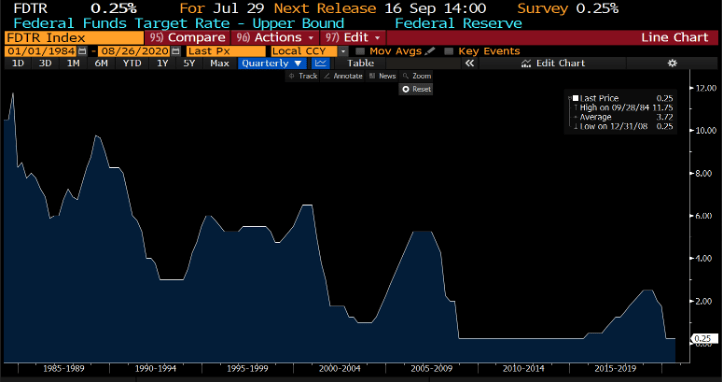

Here is a graph of the history of Fed Funds. It's easy to

forget all of the surprising events in the story. Rates will change. They always have, and they

always will. It may take time, but we can't forget that we are playing in this

crazy and wonderful game we call banking. We also cannot afford to forget that as

in every game, there are ways to win and ways to lose.

Another episode in the history of banking: In 1998, we had

massive refinancing as rates made all-time lows in the mortgage market. Another:

Remember how in 2008 private label mortgages exploded, as did some of the major

investment banks in the U.S., Countrywide, Bear Stearns, and Merrill Lynch?

It's been a tumultuous couple of decades, and yet it's easy

to forget the tricks, the surprises that have sprung on us. And the competition

has been and will continue to be, fierce. Maybe fiercer now than ever.

Just as in Hell's Kitchen, the key to winning is sticking

to a solid process. Cook the fish, cook the risotto, and cook the beef

Wellington. Do it right and don't make mistakes.

So simple. And so difficult.

Final, final thought: I feel the need for a cold beer and a

hotdog that's been boiling since opening day of the season.