It was a rainy and cold weekend here in Chicagoland, so I

hope you will indulge me in a little historical reflection.

I keep hearing about the power of being "The Reserve

Currency", but what does that even mean? In the near term, it means you can

keep printing money without getting penalized via hyper-inflation, or maybe by just

major financial dislocation. As I started thinking about the current status of

the U.S. Dollar being designated the reserve currency of the world, I realized

that I did not really grasp what that meant.

How did it happen? What does it mean?

So, here is the brief history. Prior to World War I, all of

the European countries' currencies were based on gold. In other words, you

could actually go into a European bank and exchange your notes for gold bars—the

same was true in the U.S. This was commonly known as the Gold Standard. In 1914,

a major event occurred that shook this all up: World War I. During the war, the

most important countries in Europe—Britain, France, Germany, and Spain—ran out

of gold. They had to start paying their troops and suppliers with paper notes

that were not backed by gold. Meanwhile, anyone who wanted supplies from the

United States had to pay in gold-backed notes. So, the United States ended up

with "all" of the gold.

Several of the top commentaries say that being the reserve currency

indicates:

You control the seas via a powerful naval force.

Everyone will accept your currency as de-facto "good."

The reserve nation will only accept other countries' exchange rates when backed by hard goods.

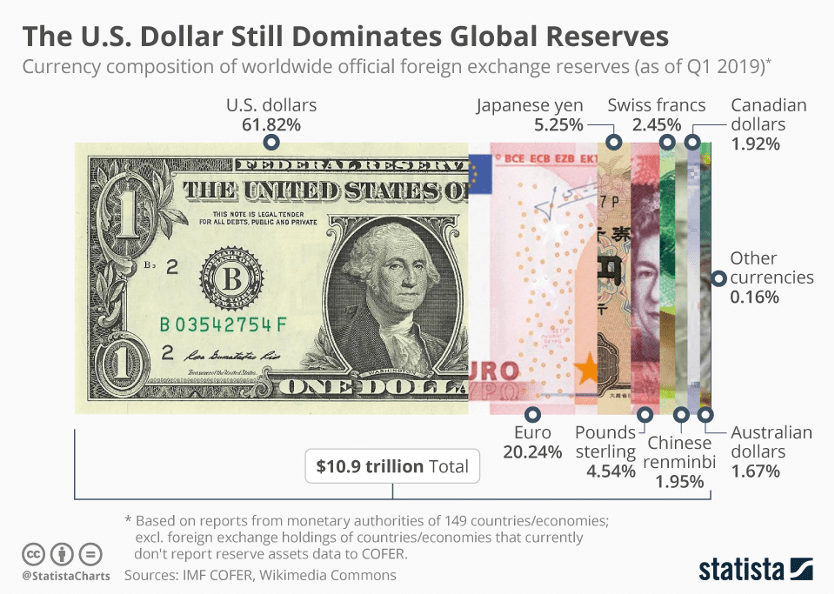

So, where do we stand today? Currently, around 62% of all

foreign bank reserves are designated in USD, and just under 50% of all

debts/bonds are designated in dollars.

Think about it: If you go anywhere in the world and walk

into a store, they will know the approximate exchange rate for US dollars

versus the local currency. In many cases, they would actually prefer US dollar-denominated

bills to their own currency. Just think of someone trying to pay in Peso

denominated bills at a McDonald's in Indiana. How about Euros? Want to have a

little fun? Take a €10.00 note to the local McDonald's! They won't have any

clue what to do with it. Yet if you pulled out a $10.00 bill anywhere in Europe,

they would accept it. Maybe not at a great exchange rate, but they would take

it. Do you realize how meaningful that is?

Before I dig too deep into the implications, let's do a

quick review of reserve currencies. There haven't been many in the long history

of the world.

The first, truly reserve currency was the Denarius from

Rome. Rome was the first true superpower to create coinage. All of it was

backed by either silver or gold, and most of the coins could be melted down to

the base metals they represented, namely silver or gold. When I think of the

power of Rome, I always think of the Roman legions. They were by far the most

potent fighting force in the world. I do not usually think of the Roman Navy in

the same way. However, as it turns out, they had the most powerful navy at the

time. It was actually considered a little "un-Roman" to be part of the navy,

but they were still an impressive, un-challenged fighting force. In fairness,

they were most likely un-challenged because if one was to challenge them, the

Roman legions would show up on your doorstep and destroy you and all of your

major cities. Still, it's an important fact that they controlled the seas.

Having said that, the Roman military had unquestioned enforcement powers

throughout the civilized world. They didn't mess around. The Romans also,

convincingly, enforced taxing authority over the vast majority of the known

world. They collected much of the gold from their provinces with this taxing

authority.

With the fall of Rome, the Dark Ages set in and there was no

new reserve currency until the European hegemony was established in the 13-15th

centuries. Gold was the only real standard of exchange. The Dutch Guilder was

actually the reserve currency of the world for almost 200 years, in the 17th

and the 18th centuries. They controlled trade and actually had the most

powerful sea force in the world at that time.

The British Empire's Pound claimed the title of reserve currency

somewhere in the mid-1800s and remained on top of the heap until the world

changed with the onset of World War I. The British and all of the great

European powers tied their currencies to gold. The last hold-out was Britain.

They finally gave up the gold standard in 1919 following the "war to end all

wars". Side note—the Spanish Flu pandemic was also raging across the world at

the time. Even though Britain gave up the gold standard in 1919, the pound

remained the de-facto (if unofficial) reserve currency of the world. Everything

was quoted and expressed in British Pounds. Unfortunately for the entire

civilized world, that war did not in fact end all wars: World War II followed

shortly afterward. And we think we have it bad this year! During World War II,

all of the allied powers were again buying goods from the U.S., and so, we

ended up with most of the gold we hadn't already mopped up the first time

around. Much of it is still sitting in Fort Knox to this day.

Following World War II, there was a historic meeting in

Bretton Woods, NH where the 44 most important countries of the world met and

actually agreed that all of their currencies would be tied to the last

remaining "gold standard" currency: the U.S. Dollar. This may be the most

important—and least-known—agreement of modern financial history. The U.S.

Dollar was established as the peg for all other currencies. Think how

incredible that is. Our economy would not and could not operate the way it does

today if not for that agreement.

Most people know Richard Nixon for one thing: the Watergate

coverup. What you may not know is that this is not remotely his most important

act as President. In 1971, President Richard Nixon took the U.S. dollar off of

the gold standard. There just wasn't enough of the physical metal to support

it.

It was a risky move, but frankly, it had to happen. The new

standard was now the U.S. Dollar. Period.

The implications of being the official reserve currency are very powerful and I think under-appreciated. We can print money in unlimited amounts without severe inflationary pressures, and we can issue debt in unlimited amounts without pushing rates massively higher.

Having reserve currency status is like having a secret superpower (if I could have a secret superpower, it would be to be impervious to calories). As with any extremely valuable power, others want it. China has long had its eye on the prize of reserve currency status. In October of 2016, they were recognized by the IMF as an official reserve currency, but as you can see in the graphic below, they are not close to realizing the goal of becoming "the" reserve currency. Imagine walking into Chuck E. Cheese flashing a big roll of Chinese Renminbi!

As with most financial conditions, things will eventually change.

The U.S. has dramatically changed our balance sheet over the past six months.

Think about the mass of dollars that we have printed out of thin air. Heck, we

don't even bother to print the paper, we just make an electronic notation!

Will this be the blow that knocks the dollar off its high

horse in the reserve currency sweepstakes? It seems pretty unlikely in the

short term, but only time will tell.

Final, final thought: Why eat plain avocados when guacamole

exists?

Be sure to fill out

the form below to subscribe to my weekly blog.