Ok, I get it. The winter doldrums have set in and at least here in the Midwest, we are looking out of our windows at nearly a foot of snow. No golf. No tennis. And today—ominously—is Groundhog Day. In the middle of this pandemic, plus a gray and cold February, it just seems to go on and on. I am tired of wearing sweatpants, putting on the same basic "uniform" as I have nearly every day for nearly the past year now. I would really like to go out to a business lunch in a sport coat, have some nice Thai food, and a good glass of cold Sauvignon Blanc. But, we just aren't there yet.

In

1993, the movie Groundhog Day came out and was hilarious, at least to

me. Yes, it's a silly movie and I'm not sure any of us will take actual life

lessons from it, but it does seem to me to reflect the way some of the capital

markets are currently operating.

To be sure, it has been fun watching the Reddit gang run up

stocks like GameStop, AMC, and most recently silver miners until their market

caps ballooned to larger than those of other great companies in this country.

What's the tie-in you may ask? Think back to Bill Murray's

life in Punxsutawney. Every morning, he awoke to the familiar sound of the two

radio announcers talking about the weather and the festivities in town, exactly

the same, day after day. At first, he thinks he has lost his mind, but it keeps

happening over and over again…will it ever end?

My parallel can be seen in both the equities and fixed

income markets.

Let's consider equities first; they always get the most headlines.

A line in the Wall Street Journal really caught my attention:

"I would just have a bad case of

FOMO if I wasn't in SPACs," said Marco Prieto, a 23 year old real estate

broker.

This quote caught my eye, because it reminded me of a

more famous and time-tested quote by John F. Kennedy's father when he was

discussing how he knew to short the market just before the massive crash in the

middle of the roaring bull market almost a century ago:

"While sitting in

the shoeshine chair, Kennedy Sr. was alarmed to have the shoeshine boy gift him

with several tips on which stocks he should own—yes, a shoeshine boy playing

the stock market.

This unsolicited

advice resulted in a life-changing moment for Kennedy Sr., who promptly went

back to his office and started unloading his stock portfolio.

In fact, he didn't

just get out of the market, he aggressively shorted it—and got filthy rich

because of it during the epic crash that soon followed.

They don't ring

bells at the top, but apparently when shoeshine boys start giving stock advice

it is time to head for the exits."

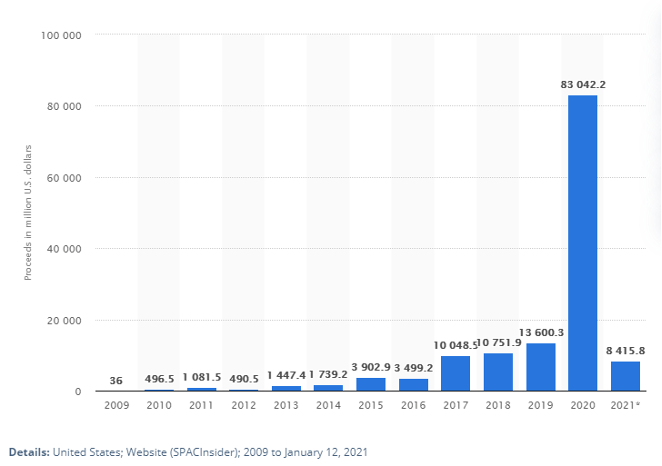

Consider the issuance of SPACs over the last couple of years. As

you know, I love a good graphic, like this one by Statista:

The farthest-right bar should not provide relief,

but alarm—that is a total of only twelve days into the year!

Recall that these SPACs are "blank check" companies

that don't really have a plan. Instead, they collect investor money to buy "something"

in the future. They take the money and happily collect a fee up front. Why not?

They also happen to retain some ownership and will enjoy the upside if at some

point they happen across some private company that wants to be sold at a really

low price. Is that enough? No, maybe they can do more, like adding leverage to

these transactions. That way they can generate even bigger fees and enjoy

bigger "upside" lottery winnings if something good actually happens. Debt is

cheap, so why not?

Back to the movie for a minute. What does Phil (Bill

Murray) do as the day repeats unrelentingly, without any change in result? He

gets wackier. He takes huge risks. Why not rob the armored truck, drive down

the rail lines, jump off of buildings, buy a random SPAC, or sell cheap options?

You get the picture.

Now let's turn to fixed income. Talk about Groundhog's Day!

Here are some current rates. I want to put it in

black and white, because sometimes it does feel like I'm sleepwalking through

this market. If you actually write them down, maybe you'll feel the pain

despite the numbness.

5-Year Treasury: 0.44%

5-Year Bullet Agency: 0.46%

5-Year NC 1: 0.55%

15-Year current Coupon Pool: 0.75%

Germany: -0.72%

Netherlands: -0.68%

Switzerland: -0.67%

France:-0.63%

Spain: -0.35%

United Kingdom: -0.02%

Yes, those are all negative! When is the last time we saw anything materially different?

We are living through a Groundhog Day scenario, but as professional money managers, we cannot take unquantified risks like the Phil Connors character does in the movie. Decisions, in this kind of world, must be considered even more carefully than usual—considered, as always, with the three most important components in mind: time, money, and interest rate scenarios.

We are living through a Groundhog Day scenario, but as professional money managers, we cannot take unquantified risks like the Phil Connors character does in the movie. Decisions, in this kind of world, must be considered even more carefully than usual—considered, as always, with the three most important components in mind: time, money, and interest rate scenarios.

Final, final thought: I'm starting to realize that I haven't been to my desk in Chicago in around six months. I hope I didn't leave any open food containers, though I am being haunted by a hopefully false, hazy memory of a half-eaten tuna salad sandwich.

Be sure to fill out the form below to subscribe to my weekly blog.