I try to stay well informed, spending much of my day reading

articles, opinion pieces, and the like, made possible by Bloomberg, the

internet, and cable. However, this week I was again reminded that I know nothing about what is going to happen in

the future. Literally.

I was watching one of those "talking heads" on a financial

channel (both shall go unnamed) and I realized that the commentator was

probably in their early 30s. That would mean that they were around 18-20 years

old during the last financial crisis in 2008, and probably in kindergarten in

1998 when we had a massive stock market crash. That did not make me think they

were not smart—or even super intelligent. Most of the younger people we hire these

days are way smarter than me; but it does mean that they have never really

experienced a market crisis before, at least not while living in the "real

world."

Think back to the days when Bear Stearns failed. Remember

Jim Cramer's "They know nothing" rant on CNBC? If not, you must watch this

video. The really good stuff starts around the 2:00 minute mark.

I remember it vividly because Bear Stearns was trading

around $110/share. It would not be long before Bear Stearns was gone. Zeroed

out. One of the great American investment banks—totally obliterated by

sub-prime mortgages. Talking heads in those days, perhaps except those

portrayed in "The Big Short," had no idea what was about to happen. By the

way, that movie is also worth watching, but probably not with your kids in the

room.

The invincibility of youth is nothing new. Aristotle described

it in hissecond book of Rhetoric:

"The young have strong but changeable

passions. They are quick-tempered and lacking in self-control, and this makes

them all the more likely to yield to their passions. They are eager for

superiority and easily feel slighted. They love honor and victory more than

money, and would rather do noble deeds than useful ones. As the greater part of

their life lies before them, they live more in expectation than in memory; and

as they are lacking in experience, they have exalted notions and tend to see

the good rather than the bad."

As I sat watching the newscaster confidently telling me what

was going to happen over the next several months in the markets and with rates,

I realized how unsupportable that confidence was. Yes, I am sure that the

research was being done—I could see the graphs and the analysis. It was well-thought-out and well-articulated. For me, it wasn't a question of intelligence

or intent but rather a reminder that overconfidence is always resurfacing. We

often can't even imagine the possible scenarios, let alone actually give them

consideration. How about a simple and telling example? My son is a teacher. He

started just last year, and many of you will know that one's first year of teaching

is tough. You have to build up all of your lesson plans from nothing, get used

to a hectic schedule, and by the way, teach. He happens to teach high school

and we all know that sometimes high

schoolers can be a handful. So, he made it through his first year, great, and

then- COVID. The school is planning on opening and he now needs to teach those

same students wearing a facemask and making sure they are all socially

distanced. To make matters worse (if possible), since some of the students will

be virtual, he will have to wear blue tooth headphones while live streaming, in

case someone remote has a question. Now, please tell me if anyone knew this

would be happening back in, say, January. Anyone?

A quote I often rely upon in educating is from the ancient

Chinese philosopher Lao Tzu who said, "Those who have knowledge don't predict,

and those who predict don't have knowledge." I find it profound and I find it

liberating. Those of us in the finance industry are constantly being asked to

make prognostications, predictions, and previews. It is wonderful to just respond

with "I don't know." Try it. Trust me,

you make get strange looks, but you will feel better in the trade.

So, does anyone know?

If you listened to the linked Cramer video (hopefully you

did), you probably noticed that the very people he is yelling about are some of

the most informed people in the world. Not one of them knew the future in 2007—and

neither do you today, and neither do I.

We have never seen a situation in the financial markets like

we are experiencing right now. Maybe nobody ever has, anywhere. Yields are

basically at 0-0.5% in many or all investible assets. Most of Europe's

sovereign debt is trading at negative yields. The stock market is approaching

all-time highs, unemployment is swinging wildly, and it seems like the consumer

is buying like crazy. According to several real-estate firms, homes are going

like wildfire as families flee big-city chaos for suburban calm and a home

office.

Banks have unwieldy cash balances due to the surge deposits

they received via the PPP program. I, for one, have noticed that while I am

receiving a luxurious 0.01% rate on my deposits, I am also now paying a

maintenance fee on my checking account.

To make things even more volatile, commodity prices are starting to

rise. To me, this is an ugly combination of a weakening dollar and increased

demand in the face of suppressed supply.

I would also invite your attention to a wave of new SPACs.

What is a SPAC, you may ask? These Special Purchase Acquisition Companies raise

money through IPOs for the purpose of acquiring other unspecified companies.

They don't have to have any real plan or designated target. All they are

required to do is spend your money on

acquisitions within two years, or return it. Since they are taking a fee on

your funds, do you think they will return your money? Don't be silly. They'll

buy something.

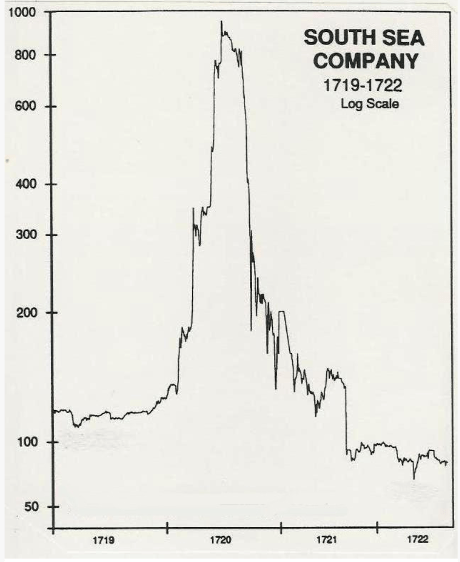

It sounds like a similar situation back in 1722. You've

probably heard of the East India Company, one of the greatest monopolies ever

established. Chartered by the English government around 1697, it was given an

absolute monopoly on all trade with the East Indies, most importantly with the Indian

subcontinent. It was extremely successful for nearly 150 years. But what almost

put it out of business in 1722 was the eighteenth-century equivalent of today's

SPACs: a venture called the South Sea Company. The South Sea company was supposed to be the "next

East India Company." Unpleasantly, they planned to deal in slaves and other very

unsavory transport throughout South America and beyond. Since the South Sea

Company was also granted a monopoly, speculation ran rampant. In fact, one of

the supposed great benefits of owning East India Company stock was rights to

buy South Sea Company stock! Crony capitalism at its best, right? Unfortunately

for them, many of the other stockholders found out it wasn't all it was cracked

up to be. However, in the short term, the establishment of this new company set

off rampant speculation all across England.

As Historic UK reports:

"Shares immediately rose to 10 times their value, speculation

ran wild and all sorts of companies, some lunatic, some fraudulent or just

optimistic were launched.

For example; one company floated was to buy the Irish Bogs,

another to manufacture a gun to fire square cannon balls and the most ludicrous

of all "For carrying-on an undertaking of great advantage but no-one to know

what it is!!" Unbelievably £2000 was invested in this one!

The country went wild, stocks increased in all these and other

'dodgy' schemes, and huge fortunes were made.

Then the 'bubble' in London burst!"

Check out this chart:

When you see things like this, it makes you realize that we

are not the first group of humans to face a bubble or unusual circumstance. It

has happened before, and it will happen again. I don't know if we are in a

bubble today or not, but I do know that if

we are, there will be no shortage of those who are confident that we aren't—right

up until POP!

By the way, did I mention we have a Presidential election in three

months?

You have to be looking both ways to survive. Rates may rise

and rates may fall. The economy may expand or burst. None of us know the future.

Final, final thought: Chicken Tikka-Masala is a delicious

dinner option.

Be sure to fill out the form below to subscribe to my weekly

blog.