So, I have had some calls to expand on the theme of my Gamma

Trap post, written a little while ago. Read it here,

if you haven't already. In fact, maybe

everyone should go back and read that to get started, because it will be

helpful to have your Option Geek hat firmly on your head before you dive

into this concept: Vega.

Before we dig deeply into the Greeks (and a wee bit of

math), let me first step back and say why the Vega insight is important. Vega is

ultimately the route by which professional option traders make money. It's that

simple. Our good friends over at the FHLB, the FFCB, and FNMA all know this

game very well, as do option professionals. By no means am I urging you to become

an active option trader, but you are already playing in this wonderful game quite

often, whether you like it or not. Most readers of this article are generally

short options throughout their balance sheets—hopefully knowingly. Where? In

prepayment risk or extension risk in callable bonds, loans, deposits, advances…and

the list goes on.

So, what is this Vega of which I speak? Vega represents volatility

or, more precisely, the implied

volatility. This magical input is what ultimately drives the price of an

option. It is important to understand that professional option traders

generally "make" market prices (input the implied volatility levels) and the

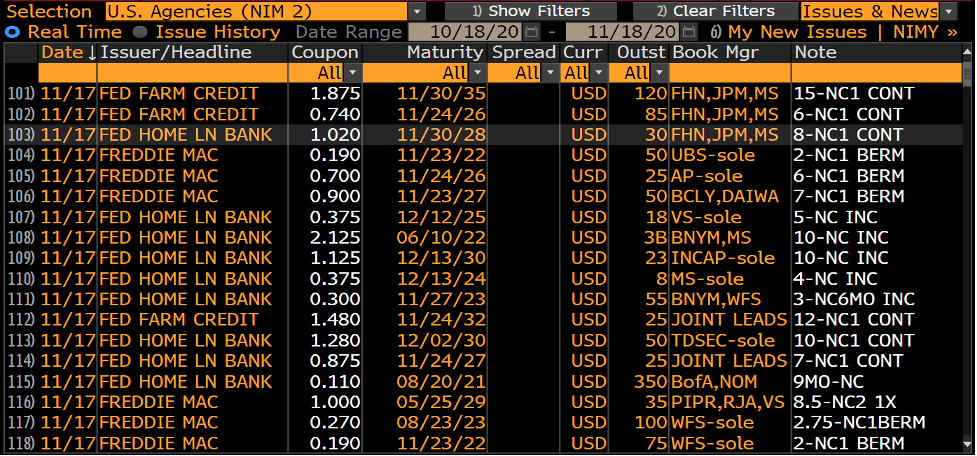

public generally "takes" market prices. To wit, when I monitor callable bond

issuance, this is what I see:

This is the New Issue Monitor via our good friends at

Bloomberg. It posts all of the new issuance across the market, all day, every

day. Most people will only see selected offerings from this daily onslaught.

Taker vs. Maker

What follows will be a tricky, but very important,

differentiator for you. I have to admit that it is not easy to explain, but I

will do my best.

Option pricing was revolutionized when firms at the Chicago

Board of Trade and other exchanges actually started applying the Black-Scholes

model to trading options on a real-time basis. The most notable of these firms

was CRT (Chicago Research and Trading). During a significant portion of the

1980s, CRT was executing more option trades than any other firm in the world.

The founder of the firm, Joe Ritchie, famously said:

"A

trader on the floor with the simplest programming calculators in 1976 instantly

became a one-eyed man in the land of the blind."

The secret sauce to this all was an understanding of Vega.

The Black Scholes model is not all that difficult. To solve for

the price of an option, you need to know the price of the underlying asset, the

strike price, the risk-free interest rate, and the time to maturity. Oh, and

you also need to know the price volatility of the asset. In other words,

its Vega. Of these inputs, all are knowable—and the same for everyone—except

Vega. Future volatility is unknown, and unknowable. We can know the historic volatility of an asset (or

group of assets), but we have to make an assumption to input Vega into a

black-Scholes model. Once all of these inputs are established, then we can

solve for the price of the option.

Prior to CRT (and a couple others), option prices were kind of

negotiated and effectively guessed. Truly.CRT became the first real market maker in the options pits. They could,

would, and did make a market in any option, at any time, with conviction and with

accuracy. They were the price maker, while (most) everyone else was a price taker.

And so, here we are again—makers vs. takers. When someone buys a 7-year

non-call 1 at 0.90% (see above), the loop is completed. I can know all of the

inputs into the equation. The price of the option has been set at 0.90% minus

the yield of the underlying. In this case, a bullet with the same maturity date

would have yielded approximately 0.75%. So, the option has been taken by the

market at 0.15%. A professional trader would be quickly putting this

information into the Black-Scholes model and solving to "back out" what implied

volatility corresponds to this pricing. We can actually get a glimpse of

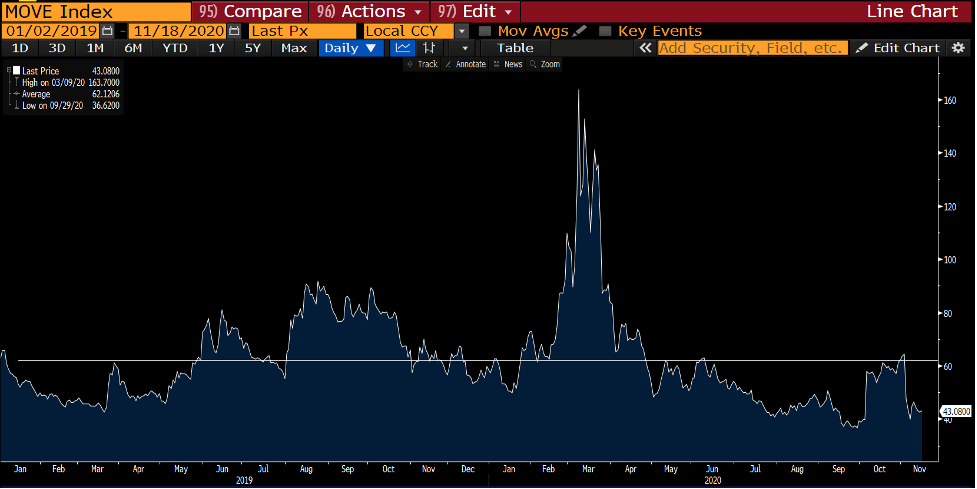

approximately where these realized volatilities have been via the MOVE index. In

the graphic, I've inserted a horizontal line to show the average for the last two

years at a level of 62.1206.

Ok, so I've had you swimming in the deep end of the pool for a

while, what's my point?

Back to my title: If the Gamma doesn't get you, the Vega just might.

I think most people are familiar with the simple rule of thumb: yields up means

prices down, and yields down means prices up. Most of the time, we think of

this in terms of the actual treasury yield curve moving, but the hidden player can

actually be the Vega.

Let us consider the aforementioned 7-year non-call 1 at 0.90%. If

implied volatilities surge (or just go up), then the option price will

increase. That is a fact. And so, without the underlying bullet's yield moving

at all, the price of the callable bond will go down. The makers will use the

Black-Scholes model once again, input a new, higher value for implied

volatility, and they will set a lower price for the callable bond.

This is particularly troublesome if you a consistently short

options (like most readers here), because suddenly everything is upside down. All of your asset prices will drop as

the makers start resetting prices. This of course will eventually lead to the

Gamma trap from the earlier post.

Those darn Greeks! Some of you may be thinking—who cares? You're not

a professional options trader, so why should you spend time thinking about

implied volatilities? You most likely have never thoroughly considered the

Black-Scholes model as a daily tool in the market place that can affect your

balance sheet valuations from loans to wholesale fundings. Most of you should

not be spending too much energy

thinking about that! But you are

competing in a high stakes game. Even if you don't consider yourself a

professional options trader, you are a professional, and you do trade options

implicitly all the time. Unfortunately, you are usually in the position of taker,

not maker, the exception being in your ability to "make" the prices for the

options you allow in your retail products, like loan prepayability and early CD

surrender penalties.

But in general, you are a taker, which is actually okay, as long

as you understand the forces at play.

Among other reasons, you have edges that the pure option trader often

does not. For example, you can decide to avoid playing in options at all in

some places, such as in your bond portfolio or in your advance stack when the makers

aren't paying you enough to take them (i.e., they are setting Vega so low as to

make these options unrewarding). Understanding

the maker's game and the impact of broader options pricing can really give you

an advantage in your game, the one we

call investing/banking.

Final, final thought: Christmas

is only 37 days away and I hear some of the shipping companies will not be able

to handle all of the AMZN orders. Get ahead of the curve, or you may experience

some serious Christmas Morning Vega!

Be sure to fill out the form below to subscribe to my weekly blog.