Phil Nussbaum, one of my mentors, had a powerful and simple

way to summarize successful fixed income investing in three simple maxims:

- Don't buy poor risk-reward securities

- Buy good risk-reward securities

- Buy good combinations of securities

So simple and yet seemingly so difficult to do. Today I want to focus on the first one: Don't

buy poor risk-reward securities. Sometimes this one gets overlooked, because it seems so obvious, and yet

ignoring this has cost some banks and credit unions billions of dollars over

the past 20 years.

As with any good three-point outline, there are

sub-points. What particular decisions

help us adhere to this maxim? To me, the

first and foremost is that we should never sell options cheaply. Now it is important to note that in order to

survive as financial institutions, we must sell options, on both sides of balance

sheet; but the real trick is to not sell them too cheaply. How can we

measure and quantify "too cheaply"?

For starters, what's the big deal with optionality? The vast majority of the public only buys

fixed income securities that are option free: CDs, Treasuries and Munis. Structurally, these are all bullets,

meaning that the exact timing of all principal and interest payments is known

and set. However, once we go beyond these very simple securities we start

dealing with imbedded options. The

simplest non-bullet kind of security is an agency callable bond. These bonds are created with an imbedded feature,

a call option, which gives the issuer the right, but not the obligation, to pay

off (and hence take away) the security when the interest rates available to the

issuer are more attractive (lower) than those being paid on the bond. Viewed from the perspective of the investor

in such a bond, the investment will be taken away (paid back) exactly at the

time when available replacement investments are providing lower interest rates

than the investor was enjoying from the bond.

Why, you may ask, would an investor sell an issuer the option

to do this? That's a fair question. The

sole reason is to boost the short-term income the investor enjoys above what a

non-callable bond would provide. By

selling the option, the investor does receive a higher coupon until such a

time as the Agency calls the bond. Agencies

love issuing their debt in this form, even though it costs them slightly more

in the short-term, because their ongoing cost of debt will reset down in lower

rate environments but cannot reset higher prior to maturity (a maturity that

gets pushed out every time the debt is called-and-replaced). In addition, many brokers love to sell these

types of bonds, because when they get called prior to maturity, it creates the

opportunity to make another sale to replace it.

There is nothing intrinsically wrong with selling a call

option, but in my career of decades, I have never seen these options being

priced sufficiently high enough in Agency

debentures to compensate the investor for the true risk of them.

Once the Agencies discovered they could create such a

wonderful source of funding for themselves, they did what Wall Street usually does,

and pushed the envelope even further. They discovered that they could issue callable debt that "stepped-up" in

coupon, a term I'm sure was selected for emotional appeal. After I explain it,

I'll tell you what I think it should be called (don't worry, its family

friendly!)

This investment became very popular with banks and credit unions because it gave them false sense of happiness in having a coupon that would move higher as time passed, which felt safe in case rates went higher. To me, this has been one of the worst investments hoisted upon the banking industry in the history of fixed income creation. Not only did the investors get lower coupon income while they held them, but all of these bonds were called away and had to be replaced with something on the balance sheet—in one of the lowest rate environments of all time. The sad truth about these structures is that investors in them would never have won, even if rates had risen. The math made this demonstrable from the get go—the later higher coupons don't make up for the earlier low ones sufficiently. So hence my better name for these: rather than "step-ups" they should be "start-lows".

This disturbing situation caused me to commission coasters with the message to "Stop—Don't Buy Callable Step-Ups!" printed on them. Here is the artwork I submitted for the coasters, and they came back very nice, if you ask me. If you want one for your desk, your living room, or your bedside table—just shoot me an e-mail!

The other major, and arguably subtler, sold-option risk lies

in the world of amortizing securities. Let us first examine the very popular world of pooled mortgages. When dealing with a security which consists

of numerous independent mortgages, we must realize that we are subject to the

whims, or circumstances, of perhaps hundreds of individual mortgage holders.

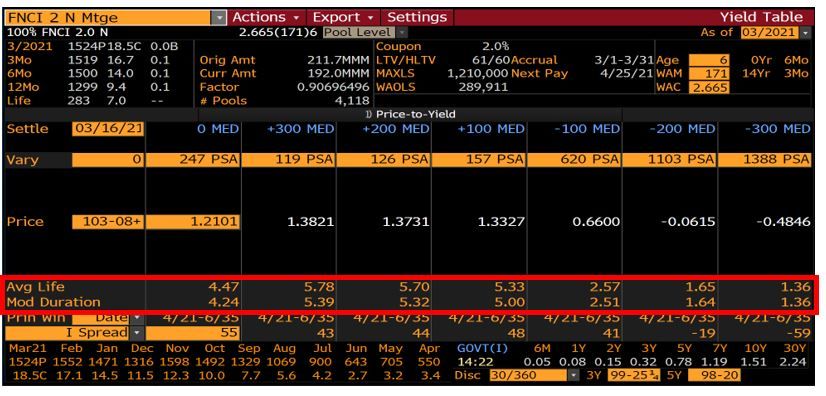

Below is an image of how mortgage pools are represented to

the marketplace. This is not the time, nor the place, to dive into the various

"goods" and "bads" of the Bloomberg yield table (you will have to attend one of

our classes if you want that!), but at least let me invite your eyes to the

field described as average life (red box).

You will note that these numbers change from column to

column based upon the different interest rate and prepay assumptions indicated

above them. The marketplace would

describe this feature (changes in average life with interest rates) as negative

convexity, but for our purposes here, we can just say that there is

optionality imbedded in the security, regarding the timing of the

piece-by-piece return of principal to the bondholder.

The only way to fully comprehend the potential impact of

this optionality is to count the actual money one would receive, over time, in a

wide variety of different future interest rate scenarios. Doing this does, of course, require making some

assumptions. One thing we do know from

long experience is that taken collectively, pools of are not as efficient in exercising

their option as are the professionals making these decisions for the Agencies.

In the mortgage backed securities (MBS) market, there have

been periods of time when investors were being offered plenty of value in

exchange for selling this option, and periods when investors were being offered

too little. While MBS offerings are far more varied and idiosyncratic than

callable agency debentures, I would opine that currently they are generally being offered with too little

compensation for the sold option.

The takeaway: don't sell cheap options.

My second sub-point under "Don't buy poor risk-reward

securities" is this: Don't blindly follow unquantified rules or traditions.

I cannot tell you how many bank investment committee, ALCO

and board meetings I have been in, but I can tell you that there is often one

common thread, namely, "We have always

done it this way". This at its face may seem

like a logical habit, but it can be so costly and destructive.

I will address this sub-point much more briefly, but also much

more philosophically.

Currently, the mantra in investing seems to be to "stay

short", because "rates are going up," is stated as a fact. Yet when we actually

measure the risk-reward of confining your investments to the 2-4 year "short" portion

of the curve, where currently none exists, we can calculate that even in a rate

rise, you will lose! This is not always

the case. Sometimes that part of the

curve is the best place to be, but my point is that whenever popular dogma

overtakes actual risk/reward measurement, watch out for trouble. Sadly, this error is often combined with selling

cheap options. Because the yields on

these "short" sectors are so low, many investors feel compelled to sell

imbedded call options to boost income. This usually leads to a "double whammy" of bad outcomes.

The takeaway: don't let dogma drive decisions.

Some will say that I repeat myself (certainly my children

do!).

As I get older, I find myself telling the same stories, over

and over. Hopefully, my grandchildren

will think it's cute. Cute or not, I'm

going to do it here.

We need to stop making decisions under pressure relying only on static, single statistic parameters. These include (but are not limited to): yield, duration, and spread. These three words, when imbued with too much authority, become poison for investors.

Yield is not what you will get. And if you have sold imbedded options, it

probably won't even be close to what you actually get.

Duration is not a length of time. It is supposed to measure risk, but in almost all cases, it does this poorly. If you do not know what duration is—and how it is calculated—you should not be using it for anything except regulator-satisfying ALCO reports.

Spread is an expression of yield. It is also a terrible metric by which to make

investment decisions.

And this is where I repeat myself: we must develop methods

for actually counting the actual amount of money we will make, over time, and

over a variety of interest scenarios, and then somehow consider all of those

possibilities together, against the same full counting for alternative

investment choices.

The takeaway: single statistic parameters are suspect.

Phil's first maxim, "Don't buy poor risk-reward securities," seems obvious and simple, but the devil is always in the details. Unless you are brand new to this wonderful game we are playing, called fixed income investing, you have sure made some mistakes in your time. We all have, and will. We just need to minimize them, and do our best to not repeat them. In the meantime, do not succumb to pressure tactics from brokers, or anyone trying to sell you investments (or loans, or liabilities, etc.). The more aggressive/desperate they become the more wary you should be.

Final, final thought - Haagen Daz has started a new line of spirit inspired ice creams. I tried the Bourbon

Vanilla Bean Truffle. It is a game

changer. There are many other flavors,

too. Check out this link.

The information, analysis, guidance and opinions

expressed herein are for general and educational purposes only and are not intended

to constitute legal, tax, securities or investment advice or a recommended

course of action in any given situation. Information obtained from third party

resources are believed to be reliable but not guaranteed. All opinions and

views constitute our

judgments as of the date of writing and are subject to change at any

time without notice