One of my favorite reads used to be the Gartman letter. I returned to it every day because Dennis Gartman covered a wide range of topics, from military actions around the world to grain trading. I really don't know how he kept up with it for so many years—I mean the thing was like 8-10 pages long, every single day! Sadly, Dennis retired at the end of 2019. One of my favorite subjects through the years was his annual coming year prediction letter. While I'm nowhere near as smart as Dennis, and since he won't be offering predictions for 2021, I guess it's okay if I take a shot on some of my own personal predictions. Keep in mind, this is a mere exercise of personal fun. You know from my previous blogs that I do not believe in interest rate guessing because data shows that it is a highly inaccurate and misleading activity. And, if something as straightforward as that cannot be done by some of the smartest economists in the world, we know that it is doubtful that these more complex predictions will come true—but my hope is that they are least entertaining or will spark conversation. Enjoy, and please shoot me a note if you think I should—or should not—repeat this idea next year!

China will continue to increase its dominance of the South China Sea.This is actually pretty much a lock. Here in the United

States, we are so focused on COVID and politics that sometimes I think we

forget to watch what's going on in other parts of the world. The South China

Sea lies between China, the Philippines, and Vietnam. Taiwan and Japan are a

stone's throw to the north. In the past 10 years or so, China has built roughly

250 standalone islands that can be used as military bases. They look like this:

No one "lives" there. This has

caused incredible stress in the region and we (the United States) have been

essentially unable to stop this incursion.

My prediction—they will not stop

building.

There will be

a major hack into a top five bank in the Unites States.

This also feels a little like cheating…it may have already

happened! On December 31st of last year, a group calling themselves Sodinokibi managed to breach the

defenses of the Travelex network, which impacted the operations of Lloyd's

Bank, Barclays, and the Royal Bank of Scotland. The hackers demanded a modest

4.6mm pounds as a ransom…which was quickly and somewhat quietly paid. Those commenting

on the matter said the hackers really screwed up, because once they were "in"

they should have just remained quiet and slowly stolen money over the years to

come. Has somebody else, more subtly, already done such a thing in the U.S.? I

certainly don't have any information, but I'm going to predict that at least one

significant breach will be discovered in one of the top five banks this year.

Just for the record, as of this writing, it would either be JPMorgan Chase,

Bank of America, Wells Fargo, Citigroup, or U.S. Bancorp. Since this is a new

year and I know you are all feeling generous, I would also like to include

Trust Financial and PNC. If any of those seven banks is revealed to be (or have

been) a victim, this prediction counts.

M x V = P

x Q adjustments

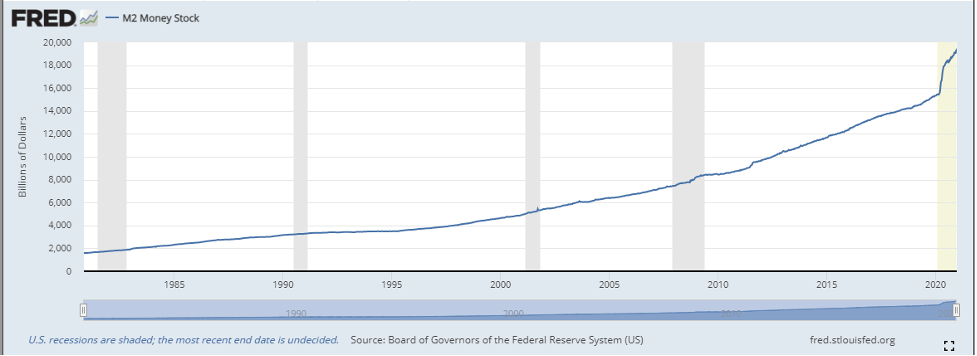

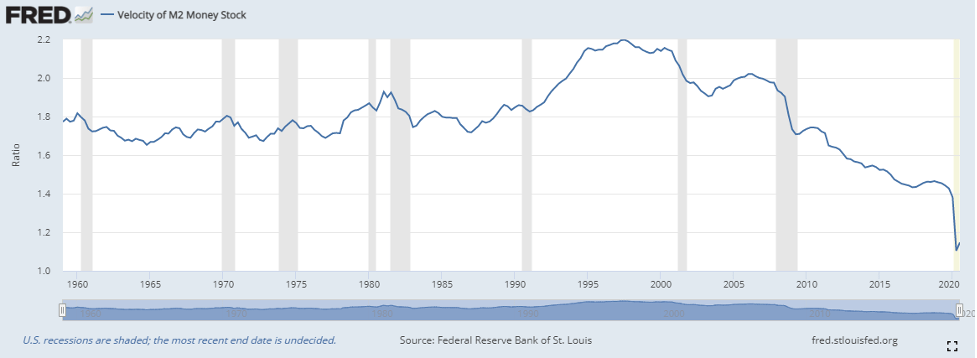

Those of you who follow my blog know that I obsess over this

formula. It is often referred to as the Quantity Theory of Money, and most

economists regard it as the baseline of economic theory: M = the money supply,

V = the velocity of money, P = Prices/inflation, and Q = output (or GDP). This

formula is in serious flux right now. The money supply (M) has absolutely

ballooned.

And at the same time, the velocity of money (V) has absolutely

cratered.

So, we know that the M x V portion of the equation is—at best—unsettled.

The question is what will happen to the other side of the equation. Will both P

and Q remain unchanged or will they fluctuate wildly? I believe the most

vulnerable part of the equation is the P. Never in modern history has a country

borrowed such an incredible amount of money as the U.S. government has this

year. Inflation must be a worry. My prediction: we will see an uptick in

inflation in 2021.

The return of slope.

As the market begins to anticipate some inflation, we will see

some slope return to the yield curve. The 10-year U.S. Treasury closed out the

year at roughly 0.91% and the 2-year was at around 0.12% which gives us a slope

of 79 basis points. Just to refresh everyone's memory (including mine) the 2-year

began 2020 at a yield of 1.58% and the 10-year was at 1.88%, so we actually gained

slope over the course of the year. This is actually kind of a tough call for

me, but I believe the inflationary fears will start to build in the market

which should theoretically push up yields on the longer maturities. It is

difficult to imagine the short end really jumping, given the Fed's language and

their current plan to hold short rates really low for a long period of time… so,

I think my case is good. We have seen the dollar getting crushed over the last

couple months (it's currently trading around $1.23/euro), and I think you can

attribute this to so darn many dollars being sloshed around. Additionally, oil

is starting to run and there could be some COVID exacerbated supply issues… we

shall see, but I like my chances. My prediction is a slope between 2s and 10s

of at least 200 bps, which means the 10-year would have to go higher.

Brexit

will be a minor bump in the road.

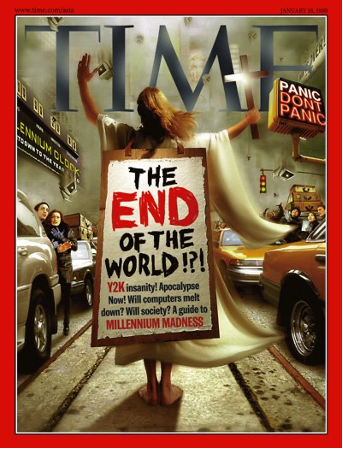

To me, Brexit is a little bit like when we all thought the world was going to stop spinning on January 1, 2000. For those of you who remember, banks all over the world were waiting with bated breath for the moment at which all of their computers would suddenly have to acknowledge that 00 came after 99. I remember being on call at midnight, waiting to see if everything would crash and chaos would ensue. Time magazine had this as their cover.

Yes, for all of the millennials out there—people

really thought that everything might crash. There were even movies made about

what was going to happen. They weren't very good.

There will

be a binary event in Bitcoin.

In fairness, this is a little bit of a cop-out. I don't know which

way bitcoin will go in 2021, but I do think it will be a seminal year. Over the

past 12 months, bitcoin has gone from roughly $7,000 to almost $34,000, a

nearly 500% increase. Once again, I am having teenagers and grandparents ask me

if they should "throw some money in" which is a very bad sign. When bitcoin

made its first huge run, I thought it

was such an obvious bubble that no one should/could/would throw their money at

something so few people even understood. It was like the internet bubble of

2000; it was obvious. However, for those who survived the internet bubble and

put their money back into the NASDAQ in 2000, recall that the rewards have been

unbelievable. Quick memory update: In March of 2000, the NASDAQ closed at

around 5,050; by the end of 2002, it was at 1,250. That's a massive decrease --

for round numbers, let's call it a 75% decline! And yet it closed out 2020 at 12,888!

That's 1,000% in 18 years. Bitcoin had a (will we have another?) very similar

pattern. If you hold my feet to the fire, I would say bitcoin will be much

higher in five years…but next year? I just don't know. It will be very

volatile, so I guess that's my prediction: extreme bitcoin volatility in 2021.

One of the top five airlines will fail.

So that we are all on the same

page, here are the top five airlines in the U.S. by volume:

Southwest Airlines - 20% (132,251,331 passengers)

Delta Air Lines - 16% (106,062,211 passengers)

American Airlines - 15% (99,857,863 passengers)

United Airlines - 11% (71,722,425 passengers)

SkyWest Airlines - 5% (31,257,149 passengers)

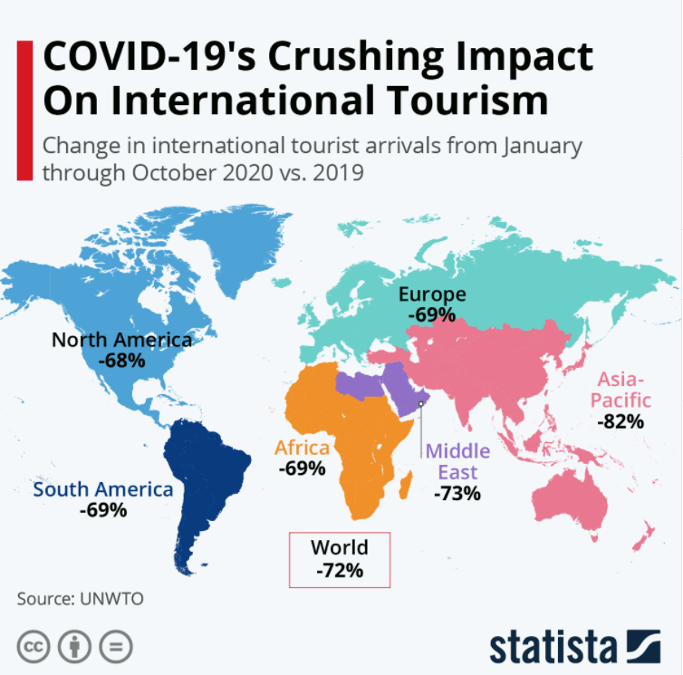

You may think this is a little drastic, but after all, this is a prediction and so I need to be a little aggressive. If you stop a moment and think about it, it seems kind of obvious. Business travel has essentially ceased. International travel has largely come to a standstill. These airlines live on business travel, which I miss so much! While I was partaking, I thought it was just a grind, but after sitting in my home office day after day in Chicago where it is gray and cold…you get the picture. I also saw this stat from Statista which really brought the reality of the situation home.

This graphic represents tourism around the world.

I believe the

airlines here in the U.S. that are most at risk are probably Delta, American,

and United because of their huge dependency on business and international.

For this

prediction to be correct, let's say one of them fails or is purchased by one of

the other carriers.

The

vaccine will work.

I've spent much time watching copious amounts of videos and reading

numerous articles about COVID-19 and the associated vaccine effort. I don't

understand all of it, and I don't think many people do, but the science behind

the mRNA delivery system utilized in the vaccine is literally mind-blowing. The

fact that scientists were able to develop and deliver this highly effective

vaccine in a short timeframe will go down as one of the great miracles of our

era. The vaccines will have a massive impact. My prediction: I will be able to

attend a Cubs game at Wrigley by mid-summer. (I doubt they will make it to

October!)

Numerous colleges will (start to) fail.

Some

of you may say this is a cheat, but I think it is actually a legit prediction.

Currently, there are around 5,300 colleges in the United States, and many of

them are in trouble. In March of 2020, at the Satellite 2020 Conference, Elon

Musk said:

"You don't need college to learn stuff," he said. The

value is "seeing whether somebody can work hard at something." He added that

"colleges are basically for fun and to prove you do your chores, but they're

not for learning."

Similarly, the founder of PayPal, Peter Theil, started

paying kids to drop out of college. He had kids apply for $100,000 grants to

start a new venture. But these two figures do not form the basis for my

prediction.That honor belongs to the

tuition bill I just received for my son. I love the school he goes to and I

definitely want to support his educational goals, but come on…he doesn't

actually go to class! Luckily, the school he attends is great with technology

and the teachers seem to show up for the Zoom calls, but is it really worth the

100% of tuition that I'm being charged? Really? What about the schools that

were already pretty weak and/or don't have the technology chops necessary?

My prediction is that people will refuse to pay for an

inferior product, as they should. I think 10% will fail, so let's call it 530

will close and/or be forced into mergers with other weak schools. Maybe not

completely closed in 2021, but the trajectory will be obvious. I think it's a

layup.

The Cubs are going to be bad, but not terrible

This is an emotional hedge. I

think that the Cubs will finish 2nd in the National League Central,

but still make the playoffs as a wild card. Then I think they will lose. It

will be a struggle. Pitching is lacking. It's kind of like when I played high

school basketball: I wasn't fast, but I

couldn't shoot. They don't have pitching and they aren't going to be able to

score runs. It's sad, but that's the way I see it.

Ok, so there you have it, my personal

predictions. While this was a fun exercise, I do not expect much accuracy. Given

that the economists who predict rates only came within 100bps of where rates

actually were less than 25% of the time

over the past 13 years, I will be happy with a 50% hit rate. I would love

to hear your personal thoughts about where 2021 will take us!

Final, final thought: This could have been one of my predictions, but it's so obvious—I believe 2021 will be better than 2020!

Be sure to fill out the form below to subscribe to my weekly blog.