I'm not sure anyone will ever fully comprehend what has

happened in the United States so far this year.

Obviously, we have been going through this once in a lifetime pandemic

and then just when things started to reopen and "normal life" looked to be

reemerging, riots and protests began across the country. There are fires burning across our country,

and yet the stock market just continues to rise—relentlessly. On March 21st (78 short days ago)

the S&P 500 hit its lows at 2,191.86 and as I write, it has just hit 3,207. That is an increase of 1,000 points, or

almost 50% increase from the lows, in less than 3 months! Amazing.

This week, the Fed will have one of its most important

meetings in the last decade. There is

talk of implementing caps on short to intermediate rates. Some think that if the Fed gives guidance that

short-term rates will stay extremely close to 0% for the next three years or so

that it will give them some room to cap rates on Treasuries out to that

term. What will the caps be? How will they do it? They know that issuance will be massive—it

has to be to cover all of the pandemic related costs that the country has

absorbed. The Fed is also printing money

like mad. If we look at the money

supply, we can see that it has skyrocketed and will continue to do so for the

foreseeable future. It has gone from

roughly 15.5 trillion to over 18 trillion, an almost 20% increase, in just

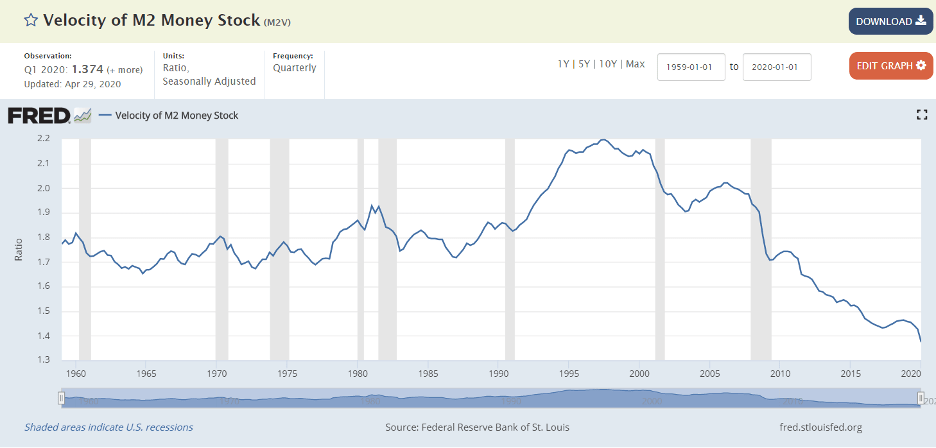

three months. At the same time one of my

favorite statistics, the Velocity of Money, has dropped to an ALL TIME low.

Speaking of the Fed, whether they want to admit it or not,

they will have to discuss the possibility of negative rates. I have

yet to discover any "real" bankers that think negative rates are a good

idea. As far back as January—before all

recent current events—Jaime Dimon was interviewed on CNBC and said that one of

his greatest fears for the banking industry was negative interest rates. He said, "It's kind of one of the great experiments of all time,

and we still don't know what the ultimate outcome is." When you look around

Europe, there are currently 16 countries with negative yields on their

sovereign debt out to five years. The

German 5-year note—which has a 0% coupon— is currently trading at 102.84 and is

yielding -0.58%. It makes no sense. If the Fed ever does decide to go negative, it

will be a serious knock against community banking. Forcing people to pay the government for the

excess reserves they are required to hold does not seem logical. At the end of the Fed meeting, we will all

wait with bated breath to see how they guide and how the markets will

interpret their actions. It will be

interesting to say the least. On the

plus side, there is good demand for new housing and refinancing of debt. New home starts, which were forecast to be around

480,000, actually came in at 619,000.

The refi index spiked in early March, but has tailed off slightly since

then. However, it is still at levels

above this time last year. Confusing…am

I right?

Back

to the stock market. Apparently the

airlines are saved. Southwest (LUV) has

gone from almost dead at $22.46 to new life at $40/share. Retailers are up. REITs are up.

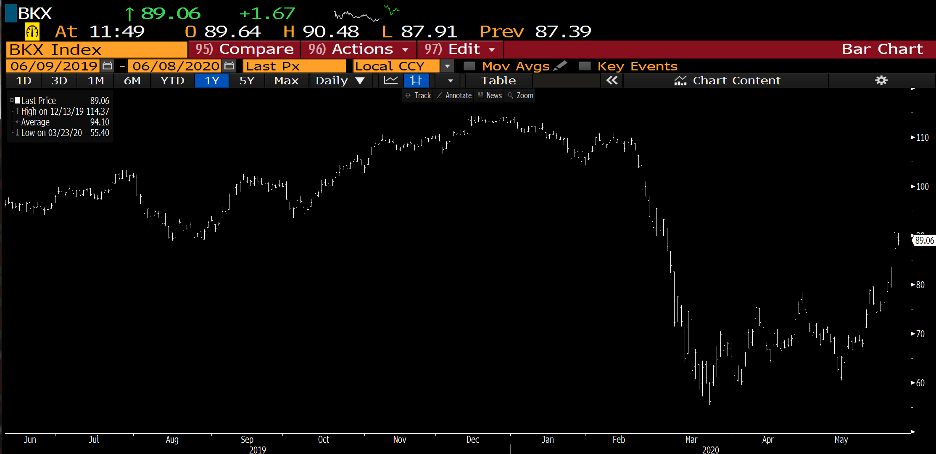

FANG stocks are up. Even bank

stocks have turned up. If we look at the

KBW Bank Index it has had a remarkable recovery.

While this looks good, the traditional bank branch model is

being sorely tested. As the Wall Street

Journal noted, "Branch traffic fell more than 30% in April and the first 3

weeks of May compared with the same period last year." They also noted that teller-based

transactions were down by 32%. If I look

at most teenagers/millennials, many of them never have been, nor will they ever,

go into a branch. What does it mean for

the industry? I think the short answer

is that only the nimble will survive.

Things are hard enough so if we do end up with negative rates it will be

a real witch's brew.

I think I would be remiss if I didn't at least mention the medium-term reality that we should at least be considering—inflation, or possibly stagflation. Historically, when countries just turn on the printing presses of money, inflation is bound to follow. The classic examples are Germany after World War II and Zimbabwe. In 2007, the Zimbabwean central bank actually printed a 100 Trillion note that is essentially art today. Being the world's reserve currency does have its privileges after all, but in the medium to long term it has to be something we don't forget about it. A number of very powerful hedge funds are buying gold because they believe inflation will eventually come. While hedge funds are only right about 50% of the time, I think it would be short-sighted to ignore the possibility of inflation.

The topic of inflation brings me back around to the brief discussion about velocity above. One of the fundamental formulas of finance (known as the Equation of Exchange) states that M x V = P x Q (M = money supply, V = Velocity, P = Prices, Q = output). The equation right now is in a state of massive flux.

M is at an all-time high. V is at an all-time low. If Q (essentially our GDP) begins to fall dramatically due to the pandemic, social unrest, etc., then the P will have to adjust up. In a strange twist of fate, the Fed actually needs to keep the velocity of the money supply low lest they set off some kind of inflationary bubble. One of the ways for the Fed to keep the velocity of money low is to buy bonds (or other assets) rather than letting the supply into the real economy. This is a dangerous game of chicken that could go either way—inflation or deflation—if they don't play their cards right. This formula obviously has an almost limitless number of inputs, many of them unknown. It is something that we need to continue to observe carefully.

I want to end with a very uplifting story. I cannot lie, it comes almost directly from last weekend's Wall Street Journal. It's the story of Amadeo Peter Giannini, the founder of Bank of America. It's truly an amazing story for anyone that finds the history of banking interesting. You can catch the full story in the "Exchange" section of that edition of the paper, but what I want to highlight is that he focused continually on the smaller businesses. Immediately after the great fire in San Francisco, he famously set up a table with his sack of gold and cash on the pier and started to make loans based on the promise and a handshake. This reminds me of just how fantastic it was to see the local community banks leading the way in the PPP program. When local communities were hurting it wasn't the big boys that really got it done—it was the community banks. This will pay off with loyalty—not only for loan products, but also for the deposits. People will remember who came through for them in this crisis.

For the full story on Mr. Giannini please follow this link

to the OCC's website:

https://www.occ.treas.gov/about/who-we-are/history/1866-1913/1866-1913-bank-of-america.html

Final, final thought.

I really miss baseball. There's nothing

better than kicking your feet up and watching your team play a few

innings. Let's all keep our fingers

crossed that it will be back soon.