The title of this post may sound like a late-sixties musical

act, and in fact, both parties are singing quite a tune together, if not in

intentional harmony. Let's start with the frontman, Dr. Copper. To me, he is a

familiar character, as he is well known among macro-market watchers as a

harbinger of the coming economy. Copper is a key input for many applications,

in many sectors of the economy, from homes and

factories to electronics, power generation, and transmission. It's also

extremely critical to the manufacture of autos, trucks, RVs, and boats. Demand

for copper is a tried-and-true indicator of economic health. It's not as flashy

as gold or silver, but it is a far more accurate indicator of real industrial—and

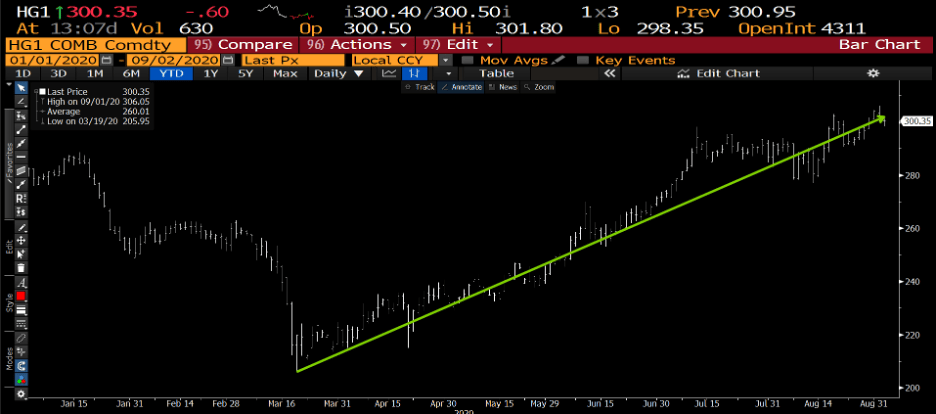

housing—development. Right now, Dr. Copper is on fire. Check out the last

couple of months.

This graph shows the price action of the front-month future

contract. Each contract represents 25,000 pounds of raw copper. So, in layman's

terms, in March it cost roughly $51,487 to buy 25,000 pounds of copper, and

today, it costs over $75,000 for the same amount. There are approximately 50

pounds of copper in every car made in America. An average home has 440 pounds of

the stuff, and building and outfitting a small store or restaurant takes roughly

650 pounds. Everyone using copper, for whatever purpose, has seen their input cost

for this go up by about 50% in less than six months. It's a lot, and if demand

is driving that, then the sentiment is clearly bullish.

I dug up some research

published in 2014 by the Dutch bank ABN AMRO that examines the correlation

between copper prices and different measures of global economic activity. Their

analysis concluded that there are indeed strong correlations between copper

prices and world trade, regional GDP growth in China, the U.S., and the EU, and oil

and gold prices. (Source: ABN AMRO)

So, Dr. Copper is

singing a peppy, upbeat song! Should we make that song this year's homecoming

theme song?

Some parts of the market seem to be—the stock market, another leading indicator, is behaving

similarly.

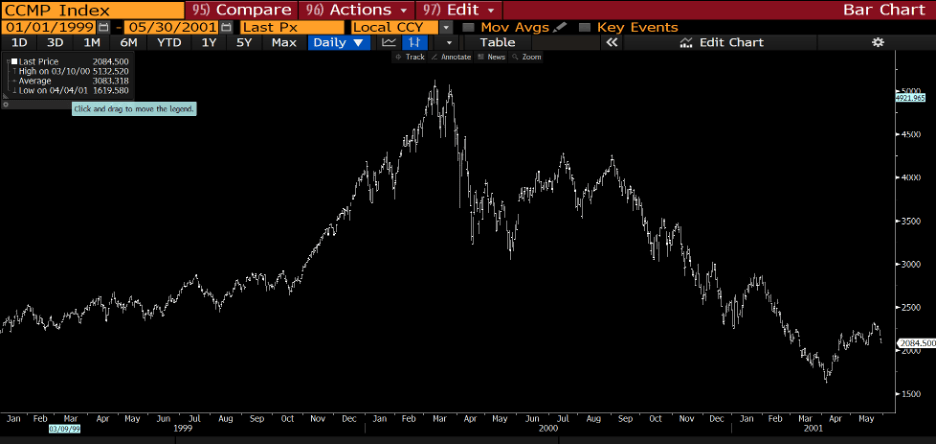

Look at the NASDAQ. What

does it seem to be saying? No problems, no COVID-19, no cities on fire, no election,

nothing.

But hold on—the

Treasury curve is painting a very different picture. For heaven's sake, the 10-year

Treasury is only yielding 0.65%. I could invest in a current coupon 15-year mortgage

pool and "earn" only a 0.75-0.85% yield...are you serious? We can't even

consistently open schools right now. Things can't be that rosy, then—can they? Another

heckler? Over half of the 5-year debt being issued by sovereign European

governments is currently trading at negative yields! Good grief.

So, is Dr. Copper singing

the right tune—or a horribly discordant one?

Which brings me to

the SPAC Brats. Let's first make sure that we all know what a SPAC is. Here is

the best definition I could find:

A special purpose acquisition company

(SPAC) is a company with no commercial operations that is formed strictly to

raise capital through an IPO for the purpose of acquiring an existing company.

Also known as "blank check companies," SPACs have been around for decades. In

recent years, they've gone mainstream, attracting big-name underwriters and

investors and raising a record amount of IPO money in 2019. In 2020, more than

50 SPACs have been formed in the U.S., as of the beginning of August, and

they've raised some $21.5 billion.

Why do they exist? To develop square cannonballs? (See

previous posts!)

I think the easy answer right now is that there is a lot of

money looking for ideas and opportunities. For me, a great example of this is Tesla

(TSLA) which is currently trading at a P.E. of 947. Yes, you read that

correctly, not 9.47, not 94.7—it's actually trading at a nine-hundred-plus P.E.

multiple.

At some point, this song starts sounding silly. I'm reminded of the hecticness of the internet bubble of 2000 when the NASDAQ reached a high of 5,132 on March 10th of 2000. Recall that by April of 2001, it was down to 1,619, a stunning drop of 3,513 points, or almost 70%. If today the NASDAQ was to drop 70%, it would fall from its current level of 12,012 to 3,603—almost 8,500 points. Wow.

Well, for starters, ask yourself what makes Bill Ackman or

any other SPAC operator so much smarter than you, or I, or the debt markets? If

we had a couple of billion dollars, we could also make some wild speculative

bets. Maybe we would hit a couple of home runs and maybe we would strike out a few

times. Believe me when I say it's always easier to lose someone else's money. I

speak from experience. When I was trading on behalf of a firm at the Merc and I

happened to lose 10 or 20k in a day, I still got on the train, went home, and

slept well that night. But once I started trading my own book, whenever I'd

lose 2 or 3k in a day, I'd feel sick and spend that night sleepless.

The SPAC operators have no downside. Sure, some of the managers put in some

of their own money, but please believe me when I repeat that it is so

much easier to spend and lose other people's money (OPM). Spend it, and there

may be an upside; if not, oh well. Think of a salesperson trying to land a big

customer with access to a company expense account. Golf, fancy dinners,

ballgames. Pre-COVID-19, he would have made a totally different risk-reward

decision if this all came out of his pocket, don't you think?

The same is true with SPACs. They have to spend the money they raise within two years, or they lose

it. Don't you think this fact might make them a little less price-sensitive on the

companies they end up buying? If they happen to hit a home run, everyone is

happy. Fees, exorbitant salaries, private planes, expense accounts—all is

forgiven. If they happen to buy the high? Oh well, that's just market forces.

Shoulder shrugs. The fees and expenses still get paid, trust me. Only not buying something leaves them with

nothing to show for it.

We may be in the middle of watching this very thing play

out. The aforementioned Bill Ackman and his Pershing Square SPAC attempted to

buy Airbnb. Now, Airbnb turned down his initial offer, but don't be surprised

if he or another SPAC comes back soon with a higher offer. Why not, it's OPM!

So, back to the title Dr. Copper and the SPAC Brats. These

are strange bandmates. Dr. Copper gained his fame playing for the "Fundamentals",

while the SPAC Brats come from the "Speculator" genre. But right now, they are

playing on the same stage.

Across the street, a depressing emo band, the Sovereign

Debts are putting out a very different sound.

One of these acts may be the next big thing, but it's very

hard to say which, if either. Maybe not a great time to all-in on either one.

Instead, maybe wait for their second albums before going on tour with either

band.

As the great economic philosopher Billy Joel put it:

"There's a new band in town,

but you can't get the sound

from a story in a magazine.

Ain't that your average teen?

Let's listen politely to both bands, but it seems far too

early to become a fanatic groupie of either.

Final, final thought: Don't forget about ice cream

sandwiches.