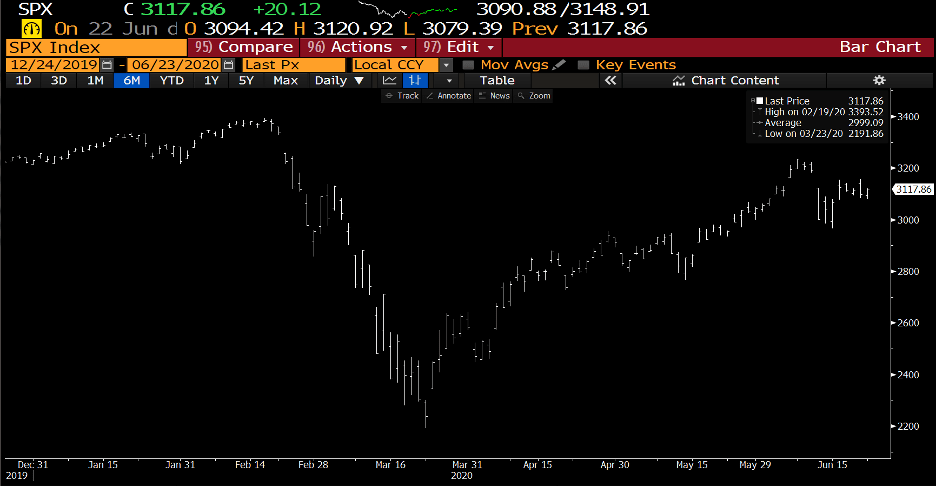

I like to think of myself as a fairly optimistic person, generally speaking. The events of the last five months or so have made that pretty difficult and I would say that my "glass" of optimism has been way down in the 10% full range for quite a while. I actually think I am getting back to half full. As you have undoubtedly noticed, the economic releases lately have been having massive swings. Whether we are talking about unemployment, retail sales, housing starts, or mortgage applications, everything seems to be jumping. These numbers must be taken with a bit of skepticism, however, because there are big impacts from the reopening of the economy and the one-time stimulus checks. The stock market, in theory, is a look-forward mechanism for our economic well-being, and as we can see from the graph of the S&P 500 (below), it has come a long way back. Having hit its low on March 23rd of 2191.86, it is now back over 3100. So, that is over 1,000 points (or 33%) in just a couple of months. Pretty impressive run.

There are a couple of other reasons why my "glass" is starting to fill up.

Oil. We all know that

oil prices can fluctuate—often in a highly volatile manner. Keep in mind that as recently as 2013 a

barrel of crude oil was $108.56. As

recently as last year, it was regularly trading in the mid- $60 range. Today, it stands at roughly $41 a

barrel. Obviously, the pandemic caused a

great part of this decline, but something happened on April 20th of

this year that may never happen again: the front month crude oil future traded

to NEGATIVE $40.32 a barrel. You

literally could not give oil away for free.

It continued its dramatic slump and did not go above $25 until

mid-May. So, why is it now back up into

the low $40's range? I think it is a

combination (as always) of supply and demand.

Indeed, the OPEC+ countries did agree to slight reductions, but don't

forget—just two short months ago there were tankers filled to the brim all over

the world that could not unload. Additionally,

I have driven around a lot more lately and my subjective observation is that

the roads are definitely busier with more truck traffic. On balance, I would say it is a demand-driven

rally. How long will it last? I have no idea.

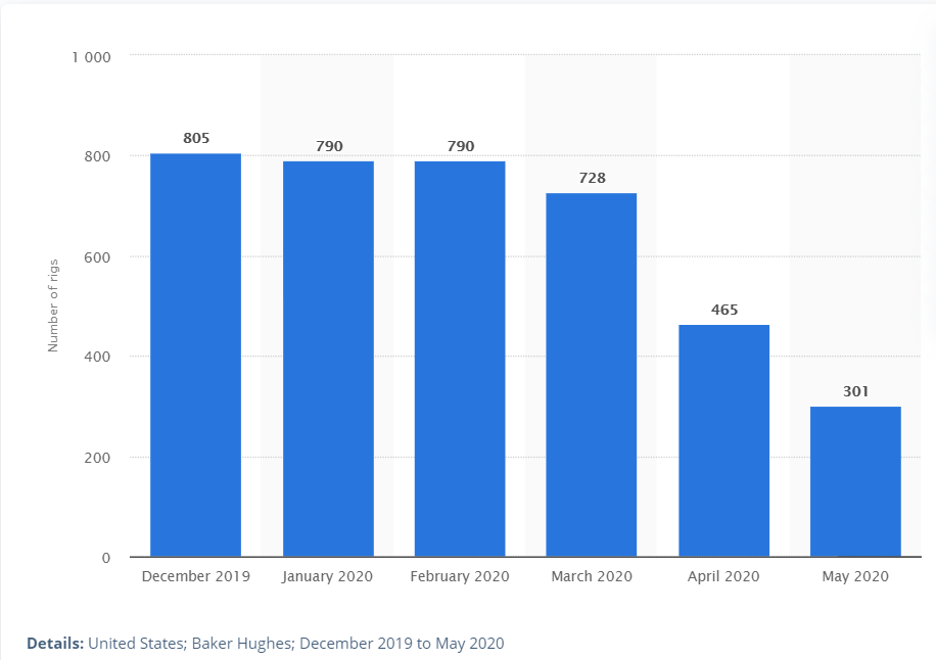

I'm not an oil man by any stretch, but I do know that the rig count in

the US dropped from roughly 800 to 300 in a short five-month span.

If/when they decide to turn those things back on, prices

could definitely falter. We will see. But

on balance the fact that oil prices are slowly and steadily rising makes me add

a few drops of water to my glass of optimism.

Office space and big cities. Conveniently, the Wall Street Journal headline on Tuesday was

"Manhattan's Office Towers Inch Back to Life."I talked about the need for our bigger cities to spring back to life in

my last post and I think this is really critical. There will almost certainly be an office

space hangover. If I owned a bunch of

mixed space commercial real estate in one of the larger cities, yes, I would be

nervous. But I think there is some hope. Younger people want the vibe of the downtown office and the option to go

to bars and restaurants on a Friday after work. I think it's really important. Plus, I believe it nearly impossible to

train or mentor a new employee via Zoom. Texting and e-mailing are bad enough! Younger employees need to learn to interact and start building their

skills so they can eventually replace the previous generations. The most common narrative regarding the

office building culture is that many companies that have successfully navigated

the remote office will give most of their employees the option to continue to

work at home—some indefinitely. For

those that want or need to go into an office via a commute, it sounds like many

offices will have 50% on each day with changing or scheduled shifts. Even with only 50% capacity, I still view

this as a plus. Already here in Chicago,

Metra has announced that it intends to begin adding more cars to their trains, as

well as more trains as ridership increases. This has much wider implications. Consider McDonald's. In late March

they dramatically scaled back one of their most successful programs for the

last five years. The "All-Day Breakfast"

menu had become very popular (and profitable), but to assist in decreasing

employee counts and complexities of operations they made the decision to

drastically reduce. If people begin

commuting again, expect to see a swift return. This affects the whole supply chain. Another example would be the brand new, fully automated Starbucks in the

train station in Chicago. It just opened

about three months ago, and Starbucks made the decision to temporarily shut it

down. Hopefully, it will re-open soon.

It is hard to imagine having to put on "real" clothes again

to go to work, but I would do it! I just

hope I still have a belt that fits.

So far, I have been talking about glasses being half full,

but I think I would be remiss if I did not talk about one glass that is

overflowing, and that is the Federal Reserve. As Bill Dudley noted in his excellent column from Bloomberg, "The Federal

Reserve's balance sheet is expanding extraordinarily rapidly and by yearend may

exceed $10 trillion. This is against a capital base of only about $39 billion,

which implies a leverage ratio of more than 250-to-1."

When you get into the weeds on this, you will see that this

balance sheet is expanding at roughly 120 billion per month. This is mostly Treasuries and MBS, but they

are also buying lots of other stuff, including municipal debt, corporates, and

bond ETFs.I'm definitely not an expert

on the plumbing of the Federal Reserve, but that seems a little crazy.

Here is a link to the full

article.

It's definitely worth your time and helps to explain a lot

of the implications and potential outcomes.

So, overall, I feel more upbeat. One thing that does really bum me out though

is that I don't feel very confident we will be seeing much baseball season, at

least for the major leagues. I have

heard a rumor that our local little league is going to start up though…so that's

a plus.

Final, final thought: I am getting on a plane for the first time since mid-March this weekend. I will definitely give you a full run-down of the experience.