America seems to be on a buying spree. On Tuesday of last week, the retail sales

numbers were released and, to the surprise of many, surged 17.7%. It was the largest single-month jump in

retail sales since 1992. As I mentioned in

the June 11th post, the real star of the show was e-commerce. Non-store sales are actually up 35% year over

year. I have a feeling that while some

people are working at home, they are also doing a little shopping on the

side. But the really cool thing to see

is that as many "non-essential" businesses such as retailers, restaurants,

salons, etc., experienced great sales due to pent up demand. The American consumer

was excited to get out and do some shopping as the weather got nicer. I, for one, can tell you that after sitting

in my house for a month, in March, with 46-degree temperatures, gray skies, and

this dismal virus news coming at me all the time, I couldn't wait to get

outside and go to a restaurant. Here, in

the Chicago suburbs, several of the local communities have closed off streets

or parking lots and set up open-air eating areas. It's like a street

party. Of course, we have to acknowledge

that we are bouncing from extremely low levels.

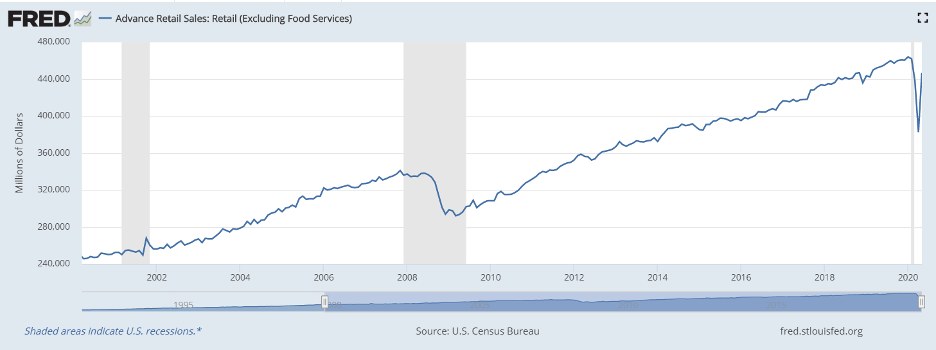

As this chart shows, the retail sales numbers had dropped off a cliff, so

this is a bounce. Let's hope it continues.

The pessimistic side of me has to acknowledge that some of

this incredible bounce may be due to the big stimulus checks and the reality

that this was really the first time people could go out in 3+ months. I will keep my fingers crossed for the next

month and hope this trajectory continues. My banking friends around the country tell me that there is a huge

interest in boat, RV/recreational vehicle loans, so that should help support

the numbers, at least for the next couple of months.

There are 2 sides to every coin, though.

As I mentioned last week, I made my first foray into Chicago from the suburbs last week. I drove. Normally I would hop on the train, but the schedule has been cut way back and I have to admit I was also a little nervous. My "right" brain said that the train is probably as clean as it has ever been since it was manufactured. I also probably would have had a virtually private car. I looked at the commuter lot as I drove by and it was almost empty, but I must say that the rush hour traffic was also extremely light and easy. Instead of the usual 1 ½ hours to drive in, it only took me about 40 minutes, which was nice. Our office is in a usually teeming train station building. On that day, it was totally empty. Eerily empty. This gives pause to the narrative above because all of the restaurants (except Dunkin') were closed. The newsstands were closed. The retail shops were closed. The reason I mention this is because I think there is a little bit of a binary outcome from this situation. IF they re-open AND people start commuting in a more regular way, then this could actually boost the bump we have already seen. BUT, if work at home is the "new normal" (and I think it might well be), then many of those operations may never open again.

I also walked around

downtown a little and it had a very different vibe than the suburbs. In the fun open-air eating areas of the

suburbs, people seemed upbeat and happy to be out and about. The few people I

saw walking in downtown Chicago—at noon on a Thursday—looked extremely nervous

and skittish. This is totally

subjective, but I thought it was pretty important. For a truly full, booming recovery, we will

need our cities to bounce back. This may be hard to accomplish. One major factor will probably be

tourism. My wife is a loyal New Yorker

and had planned a trip this summer with my daughter to go visit New York City to

catch a Broadway show and visit some museums.Cancelled.I'm no travel expert,

but I can't imagine that many people will want to be visiting our larger cities

lest they get caught up in some kind of protest. Hopefully, I'm wrong and that

will change over the next couple of months. Additionally, the thought of shopping in one of our beautiful American

cities with all the windows boarded up along the main shopping thoroughfares

doesn't seem all that appealing. This is

not a political statement in any way, but rather a financial reality. We need our major cities to bounce back.

So, why is my title "Shopping Spree(s)" …as in plural?

There are other aggressive shoppers out there: the Central Banks of the entire world. Collectively, they have plans to buy A LOT of securities. Japan has been operating as a financial experiment for a long time. They have been fighting deflation for two decades, and it was considered a "nuclear option" four years ago when they decided to execute control over their yield curve and announced that their central bank would buy as many securities as necessary to maintain levels they deemed appropriate. Most economists thought it was crazy, until now. Australia started doing it recently as well, and now there is talk that the Bank of England and even the United States might attempt this as well. Literally unlimited buying of securities. This has very deep implications for the capital markets not only in the US, but also around the world. If these programs are initiated, it will be seen by the market as a put option and could cause a buying frenzy. Why not? If I know my downside—which would be established by the FED or the Bank of England—then I have a very small downside risk. If they actually start buying corporate bonds, stocks, and munis then Katy, bar the door. It could become the ultimate risk-on trade. There is nothing that large traders and hedge fund types love more than a known downside. Think about it.

In the wide world of credit, I believe you would see a

significant decrease in spreads because the implications of this action are

that the central bank authorities will just step in and buy as necessary to

avoid a serious credit event. This would

be a boon to corporations and others that use capital markets to finance their

operations, but probably not so great for the investor who counts on the yield

derived from these products for retirement income. Where does it end?

This is a really dangerous path because the exit is so

difficult. If we do go down the rabbit

hole of capping rates, then I think you would have to see the curve flatten,

because there is no real risk. It would

also most likely decrease market volatility—but only in the short term (my

opinion). Why? Because someday—HOPEFULLY—we will be out of

this crazy situation and the yield curve controls will come off. This could be caused by an uptick in

inflation, which I discussed last week, or any number of other factors. What then? Any sell-off could be massively exacerbated. It sounds like a government manufactured

bubble to me…

Final, final thought: I think I have played more cards in the last 3 months than the rest of my entire life. I think Euchre is the way to go, but I could use a new game. Any new or better games out there?