So, the last time I went into our office was March 6 (I

think). I then attended a seminar we

hosted at Disney World from March 9-11 (where I am pretty sure I got COVID-19 -

no joke). Since then, I have been working out of my home office. That is 104 days. This weekend, I went to a wedding in

Bloomington, IN and it was wonderful. There

were 200+ people - no masks - enjoying conversations and even dancing. It felt like I had left one world and gone

into another. I am not making a

political or scientific claim, I'm just saying that it was very pleasant. I am heading into Chicago tomorrow to do some

filming and I'm actually very interested to see what it will be like. Normally, it would be an easy decision to hop

on the train and not have to worry about traffic. But I think that I will probably chicken out

and drive in. Why? I would probably have an almost empty train. Only people that feel healthy will actually

get on a train - and I hear traffic has been pretty bad. It makes no sense. Still not sure what I will do - I'll advise

next week. What would you do? And then there are the masks. What the heck? Do they help - do they not help - are they a

fashion statement? I know that here in

Illinois, I must wear a mask if I go into a restaurant or a store and I can

take it off when I actually eat, but the servers are all wearing masks and I

think the cooks are as well. As far as

pools go, you can swim laps or take lessons, but you can't just swim for

fun. And you cannot use the diving

boards - in case you are carrying the virus on your feet. I think it would be a fun study to see how

many rules have been written about containing this crazy virus. Who can keep track of all of them and who

could possibly police them? One of the

craziest things I saw here in Illinois is that husbands and wives were not

allowed to share a golf cart. I think in

3 or 4 years, there will probably be a book published about the craziest rules

that were made during this time period.

The reality is, no one really knows what is happening, how it works, or

where it will go. No one. Why? Because

no one knows the future. As the famous 5th

century philosopher Lao Tzu said: "Those who have knowledge don't predict. Those who predict don't have knowledge."

How does this impact the financial markets and banking? That's a great question. I spend a lot of time reading the pundits and

trying to decipher what is going on. As

I mentioned earlier this week, I am actually really disappointed in the

Fed. Generally speaking, I think Jerome

Powell has done a pretty good job. He

has been dealt with a really terrible hand of cards and it seems like he has

handled things pretty well in the short term.

As we all know, this has really never happened before and there is no

playbook. What disappointed me so much

was that they gave such a "clear" read on what IS going to happen and fell

squarely into Lao Tzu's conundrum. I

think it would be much better and definitely more helpful if they admitted

(which I assume to be true) that they really have no clue what is going to

happen. None. This false sense of security can actually be

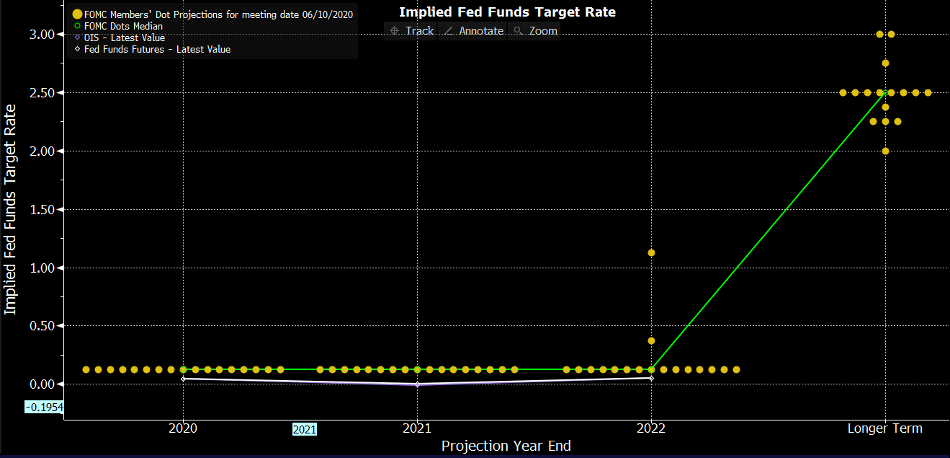

quite damaging. Here is a picture of the

"Dot Plot" that they released.

Think of the absurdity: 100% consensus through the next 2 ½

years. It boggles the mind.

My real fear though is that we fall into this trap of trying

to be overly precise. In the world of

banking, there is a great tendency to fall into the trap of exactness. The famous quote sometimes attributed to John

Maynard Keynes, "It is better to be approximately right than exactly wrong,"

has got to be the mantra we use in these uncertain times. As I mentioned in the last post, I think it's

really important for those that care about performance to do serious scenario

analysis. Admit what you do and do not

know. I am guessing there is a lot more in the "what we don't know" column

right now. Spend time discussing

potential outcomes and looking for opportunities with trusted advisors that

have different perspectives.

I firmly believe that one of the outcomes that must be

discussed is the possibility of negative rates.

For bankers, this means a robust Asset Liability engine that can quantify

that scenario. I have limited visibility

into any model that quantifies that scenario accurately, and my discussions

with bankers around the country indicate that it is not readily available. It is imperative that you? can give

credible advice in this arena. If anyone

out there has good insights into this possibility - please share it with us. There

are so many weird, wild, and crazy outcomes.

Ignore this at your own peril.

This may become a serious regulatory issue in the future, truly. Don't dismiss it.

While I am on the Keynes bandwagon, I want to share another

quote with you that I think is particularly important to the world of banking

and finance right now: "There is nothing so disastrous as a rational investment

policy in an irrational world." This is a quote from a man who died in

1946. At the peak of his powers, World

War II was happening, and I feel pretty certain that he may have said this

during those tumultuous times. It's hard

to compare a virus and social unrest of today to World War II, but the point is

the same. No one can deny that we are in

uncertain times. I see so many

institutions rigidly sticking to "Policy".

Right now, we need to learn. That

does not give one license to go out willy-nilly and start executing new and

exciting investment strategies by any means.

The risk-reward profile of doing something really badly has probably never

been higher, and believe me, there are plenty of people pushing crazy new

investment schemes - not unlike the real estate crisis of 2007-2010. One of the quotes I always use when I speak

at events is: "Integrity without knowledge is worthless and weak, but knowledge

without integrity is dangerous and dreadful."

Today, we need both - knowledge and integrity. But to just hide behind

investment policies written for "normal" markets is also a huge mistake. Make the TIME investment to get better and

you will reap the rewards. There is also

satisfaction in KNOWING when something is not actually a good risk-reward. As Albert Einstein noted, "Wisdom is not a

product of schooling but the lifelong attempt to acquire it." I apologize for all the quotes.

After all, we are all stuck in our home offices. What else

do you have to do?

Final, final thought:

I feel the need to go to Italy. When can that happen?