I'm not going to

claim that Back to the Future was a great movie—though I think Michael J. Fox

was pretty cool back in the day, and it reminds me of what we are going through

right now. Some of you will remember

that during the financial crisis of 2007-2010 (ish) the Fed lowered the Fed

Funds rate to 0%. Most people thought it

would be a short-term measure that we would work out of in a couple years. As

you can see in the graph below it lasted for seven long years. Seven years.

When the Fed finally raised rates in December of 2015, I'm

guessing there were a lot of people running models that had never seen rates

above zero before. Money managers had to

go way back in their models to figure out how to even change the inputs! As they say, history always repeats itself—and

here we are again.

Luckily for us, all of the Fed governors have a perfect

crystal ball into the future. They know

exactly what's going to happen. In fact,

100% of the voting members say that there will be no change in short-term

interest rates for the rest of 2020 & 2021 and only a very small minority

believe things will start to change in 2022.

Not only do they have perfect insights into rates over the next 2 ½

years, but they also have a pretty strong consensus on unemployment. I wish that my knowledge was that

prescient! I could make a lot of

money.

Does anyone really believe that they know exactly what is

going to happen? The stock market took

the news pretty badly, having one of its worst days in the last year or two,

and the DOW dropped 1,800 points. Yes,

the market also had renewed fears of COVID-19, but do any of us really think we

know the outcome of the virus? I

don't. If you do know the exact

trajectory of the virus, please let me know.

In addition, we have a huge election in 5 months. According to Real Clear Politics, we could

easily have a change in the White House and possibly the Senate. Do you think

that might affect the capital markets?

How can the Fed even make a rational claim that they know what will

happen through this period? No one knows

the future. It is crazy to make any

financial decisions based solely on these predictions.

I think we should be looking at multiple scenarios to

examine a few extreme possibilities—and then, hope that none of them

happen!

First, we need to consider the possibility of negative

interest rates in the short part of the yield curve. Many of the first world countries have

adopted the idea of negative central bank rates. To ignore the possibility of it happening

here would be short-sighted. Yes, it is

horrible for banks, but it is actually pretty cool for central banks. Instead of paying out for the required

reserves that banks hold, it turns into a revenue source (aka. TAX) and creates

revenue for a system that is massively in debt.

From my limited research, it does not seem that it would be a completely

crushing blow to most community banks.

It would be really annoying though.

Larger banks that have massive cash piles would definitely suffer

more. Powell and others have publicly

decried this idea, but political winds are shifting fairly quickly these

days. It is tricky to say how the

general populous would react to the potential for mortgage/borrowing rates in

the sub 1% range. In some European

countries there are actually mortgages at negative rates (check out Jykse Bank).

Although, you will have to move to Denmark to take advantage.

Ignore the possibility at your own peril. At least ask the questions of how you might

respond.

Secondly, as I discussed last week, we cannot ignore

inflation. There are a lot of very smart

people that believe the potential for significant inflation in the medium-term

is a serious possibility. Most of them

are way smarter than me and have research people working on this premise. All I know is that the printing presses are

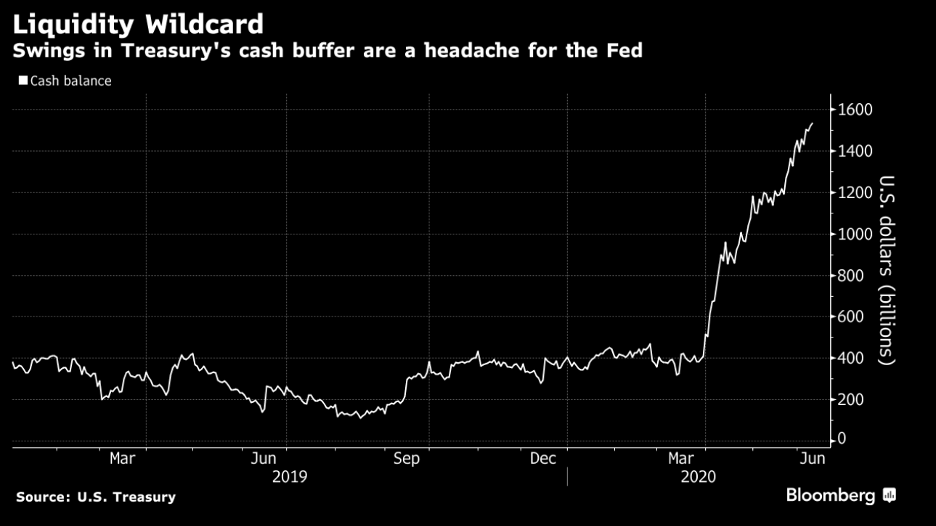

working overtime. Bloomberg reports that

the U.S. Treasury is sitting on a near-record 1.5 trillion pile of cash.

A lot of that money will go into buying Treasury securities

at the pace of 80 billion a month and MBS at around 40 billion a month. The balance sheet just keeps ballooning—does

it make any sense?

Now, I think this could actually turn out to be a much

better scenario for the banking industry, as long as it is contained. Periods of inflation and rising rates are

usually concurrent with periods of steeper yield curves and higher

profitability for most financial institutions. The key to this scenario is

containment. However, as with most

things, extremes do also cause problems.

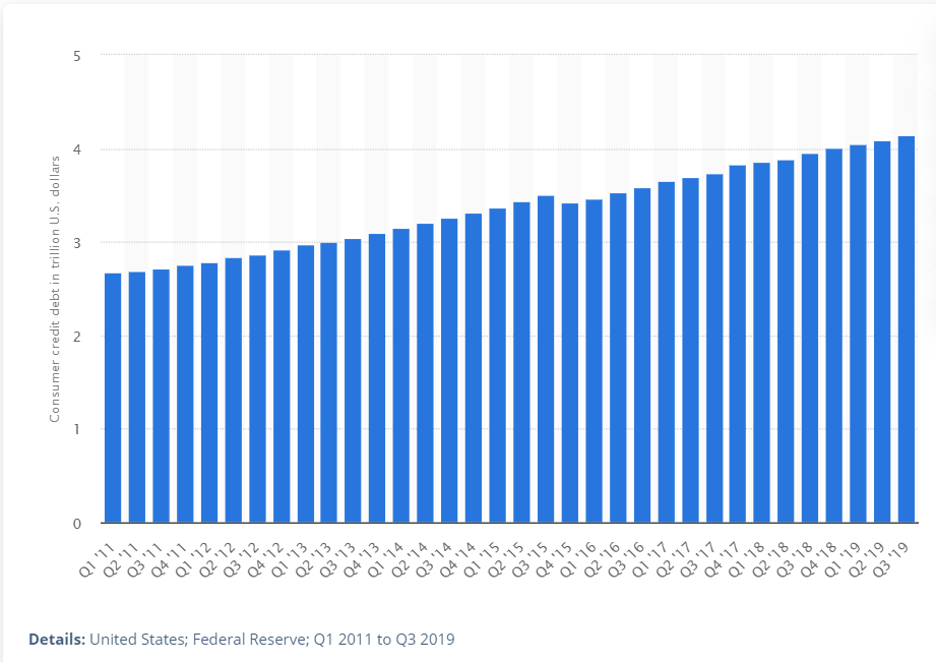

Consumers would also not be too thrilled with their adjustable rate

borrowings going significantly higher, especially since consumer debt has grown

significantly in the last decade from around 2.6T dollars to almost 4.2T at the

end of 2019. Stats aren't available for

the first quarter of 2020, but does anyone think they have shrunk?

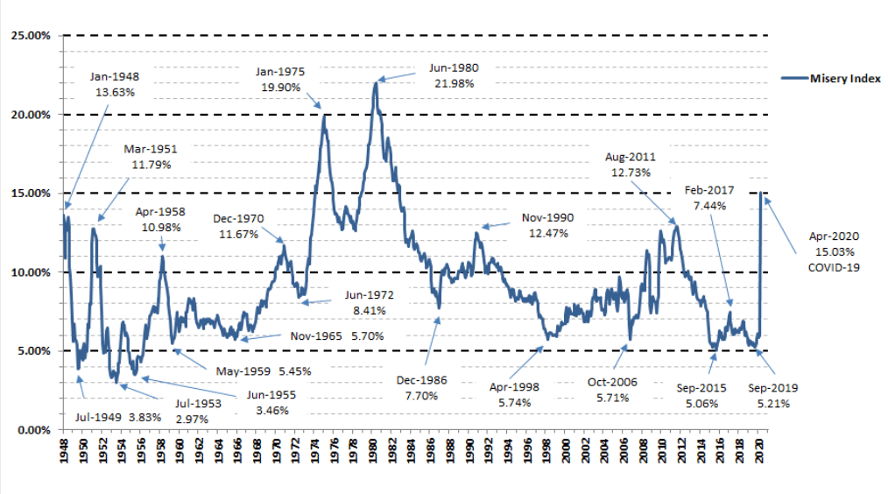

So, that brings me to a third and very unfortunate scenario—stagflation. A common definition of stagflation is that prices rise even during a period of very slow economic growth, or even a decrease in GDP. I was still young the last time the US experienced stagflation during the 70's, when OPEC relentlessly raised the price of oil and the US economy had negative growth. I'm glad I was young. The stagflation of the 70's gave rise to a little-used index called the misery index, which is a combination of inflation and unemployment. Thankfully, we don't hear much about it these days. I am thankful for small blessings, but it is hard to ignore the history of the index which shows that we aren't that far away from some significant periods in the past.

So, what's the point? If ever in the history of the financial markets, now is the time to be looking at multiple scenarios. Unlike the Fed officials, none of us have a crystal ball telling us exactly what is going to happen. I have been trading and working in the financial markets since 1989 and have never had less certainty than today. It is very strange that at the same time most market participants are the most confused that the people "in charge" give us a 100% consensus for the next 2 years. Don't fall prey to this confident outlook.

Final, final thought…Disney with masks? No thanks.