I have always enjoyed graphs and graphics, and in fact some

of the stuff that has captured my attention these past few months is best

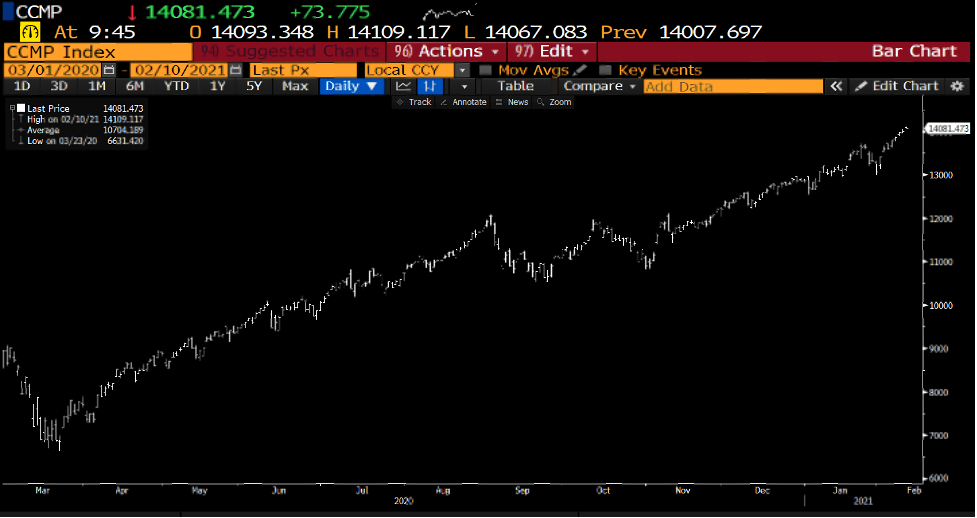

summarized in that fashion. Let me start with a graph of the NASDAQ, showing March,

2020 through today.

If your eyes are like mine, you will need to grab your

reading glasses; once you have, you will see that at the low, on March 23, 2020,

the index stood at 6,631, and today it is at 14,081. By my math, that is up

112% in less than one year. Some of the individual stocks in the index are up

way more than that. According to Market

Watch, here are the top 10 NASDAQ stocks in 2020:

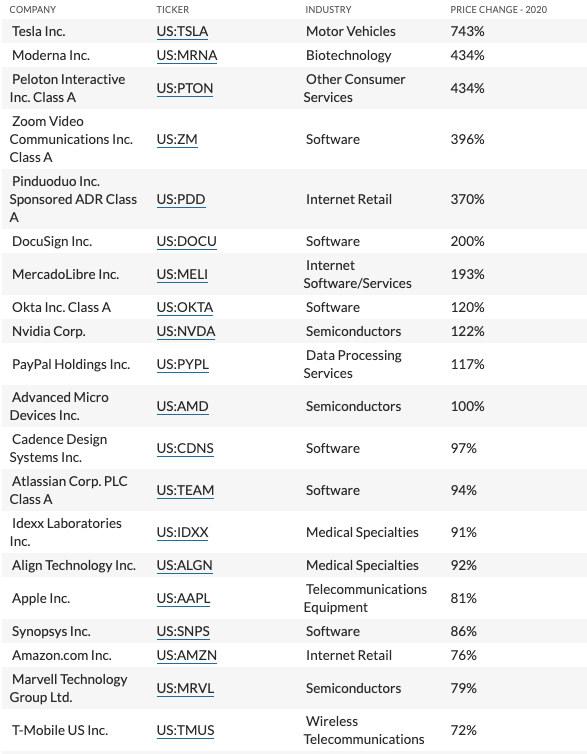

In addition to the NASDAQ, lots of other interesting things are shooting up to the moon. How about the money supply? According to the St. Louis FED, the latest measure is around 19.5 trillion dollars; if Congress has its way with a nearly three trillion-dollar stimulus package, we will see that pushed up to around 22 trillion.

It's hard to even grasp what 22 trillion means, so I thought

I should lay it out:

$22,000,000,000,000

So that is a two-digit number, 22, with twelve zeroes behind it! Another way to think of 22 trillion is

that it is 22 million millions. Or maybe it becomes more accessible to our

imaginations if we say it 22 thousand billions. It boggles the mind. This

brings to mind my often-cited formula M x V = P x Q. M is about to reach 22

trillion. Something will have to give eventually, but what? Inflation seems

like the obvious answer, unless we can somehow pull off a massive increase in

production.

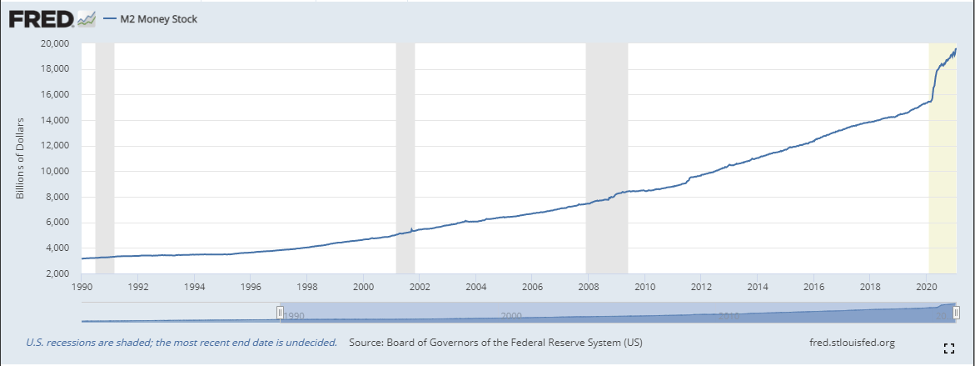

Another interesting rocket ship graphic can be made out of bitcoin. I'm a little bitter about this one, because I stubbornly refused to learn enough to get involved back when it was "cheap", you know, like "only" $6,000.

The value of bitcoin has doubled in just one month. Lots of

cool goings on here; for example, the aforementioned TSLA has announced that it

recently purchased $1.5 billion worth of bitcoin. Elon Musk has also been

trading a totally fanciful coin called Dogecoin. It was trading at around 0.3

cents a coin as recently as a month or so ago. It reached a high of almost 8

cents recently. That is almost a 27,000% increase. My son and his buddies also

trade it for fun—why not? After all, it

only goes up! It especially goes up when Mr. Musk or Mr. Snoop Dogg tweets

about it. Keep in mind—Dogecoin was created by some college kids as a joke.

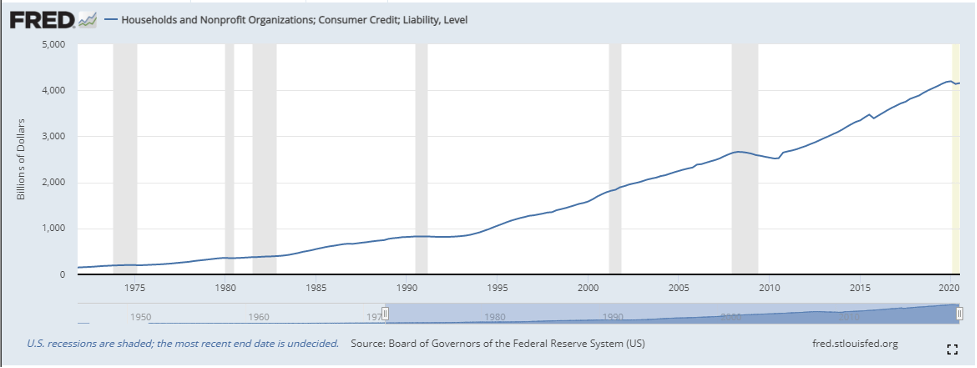

Here is another one-way graph that is a little distressing: the amounts of outstanding debt for households and non-profits. Current total is just over four trillion. Big numbers. Do I need to count the zeroes again, or are we all on the same page now?

So, I found a bunch of graphs (and believe me, there are many I'm not including). What the heck does it all mean?

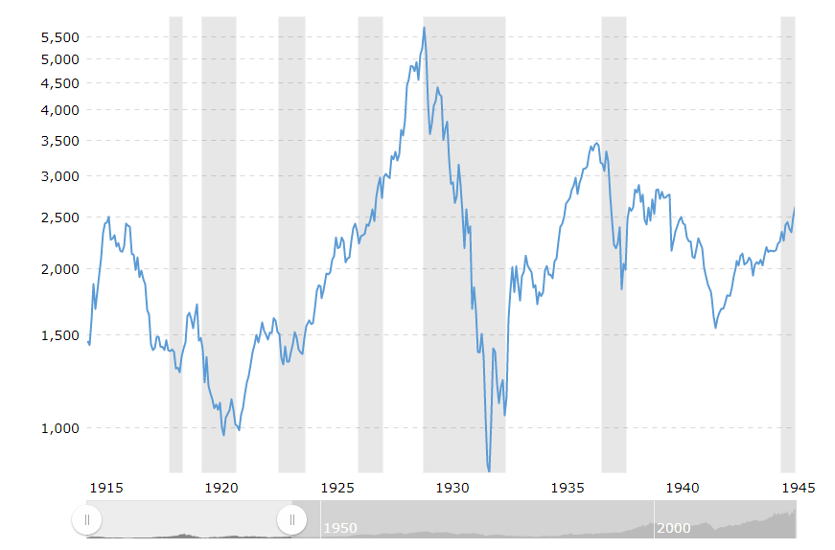

One more graph and then I will let you get back to work. Or

back to shoveling snow. It's from the last time we had appreciation of all

assets, and a debt explosion. It came to be called the Roaring Twenties.

The high point was 5,726 in August 1927. By June 1932, it had fallen 850. Am I

predicting a similar catastrophe in the coming years? By no means…but I'm not

writing it off either.

I want to

reiterate the story of Joe Kennedy I mentioned a couple posts back:

"While

sitting in the shoeshine chair, Kennedy Sr. was alarmed to have the shoeshine

boy gift him with several tips on which stocks he should own—yes, a shoeshine

boy playing the stock market.

This

unsolicited advice resulted in a life-changing moment for Kennedy Sr. who

promptly went back to his office and started unloading his stock portfolio.

In

fact, he didn't just get out of the market, he aggressively shorted it up—and

got filthy rich because of it during the epic crash that soon followed.

They

don't ring bells at the top, but apparently when shoeshine boys start giving

stock advice it is time to head for the exits."

I definitely do not want to be known as a nattering nabob of negativity, but things just don't go one way forever. At least they never have—perhaps the universe has changed?

Final, final thought: I personally still haven't met anyone who has tried to spend a bitcoin in a store, or anywhere for that matter. But that may change soon! Maybe the Tesla factory will need to buy some parts at AutoZone.

Be sure to fill out the form below to subscribe to my weekly blog.