In the course of writing this blog, I have often discussed

the importance of time in

investing, particularly for the kind of fixed income investing in which the

cash flows are known (or nearly known) and there are no credit or earnings

assumptions. The vast majority of managers who purchase fixed income

investments do not plan to flip them for a quick profit if the price of the

instrument goes up. For those of you in the banking arena, you are familiar

with the accounting option of designating securities as "Held to Maturity," or

HTM, which actually restricts one from selling them prior to maturity. Contrast

this to stock investing. Most people who buy stocks intend to sell them at a hoped-for

price, but in any case, sometime in the near term. Of course, stocks do not

have maturities, so the idea of HTM in their case wouldn't make any sense.

So, I have often brought up the importance of time in this

blog. Today, I'd like to dig into how we should think about time, and to do

this, we'll consider the Greeks. Normally, when I bring up the Greeks, I am

talking about option theory—specifically, the Black-Scholes model. Gammas,

vegas, you know.

Not this time. I'm talking about actual Greeks—their

language, to be precise. The Greeks actually have two words that we would

translate into the same English word, time: Chronos

and Kairos.

These are actually two very different ways to think about time.

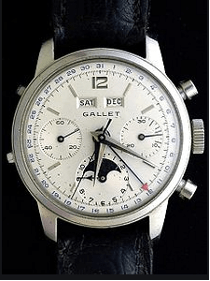

Chronos signifies a proper, or opportune, time for action. You

may recognize Chronos as the root for

our English word chronograph. A chronograph watch usually has several complicated

elements added to it, but one of them will always be a stop watch. Chronographs

are known for their extreme accuracy in measuring a specific time frame.

Let us consider the impact of Chronos on investing.

Investment

decisions always seem to be made under time pressure. Maybe the market is

moving, or the investment supply could be rapidly diminishing. Often a

transaction counter-party adds his own time pressure.

This is when you have to be in the moment reviewing the analysis and considering price, and ultimately, making the yes or no decision. No one can doubt how important these moments are and, in fact, just like timing an Olympic downhill with a chronograph watch, we have to depend on extreme accuracy in our decision making. Mistakes can be made, and they may be costly. Picture yourself in the heat of the moment with a broker breathing down your neck, asking for an immediate decision. You need to be very good in these moments. The broker-dealer community is fixated on Chronos. Virtually all of the single statistic parameters that the financial industry has created—yield, duration, spread, average life, and so forth—have been created with the idea of immediacy. Each of them is a moment in time number, and in some cases, they are extremely precise, down to three or even four decimal points, yet in many cases in their use, they can be very misleading and often even dead wrong. More on that in a future post. The nature of these statistics, or trading parameters, seem to have been specifically designed to encourage immediate action. What about catching a good price? We often feel time pressure to save one or two 32nds in price and trade analytical time to get it. When you quantify the value of this, it means almost nothing. For a one-million-dollar investment, saving two 32nds equates to $625, or $52.08 per month on a one-year maturity, $5.21 per month on a ten-year maturity. If the haste in capturing this led to a poor decision, that savings seems like very little compensation, doesn't it?

So that is Chronos;

what about Kairos

Kairos refers to chronological, or sequential time. It has a much

more qualitative meaning. This is how a logician might think of time.

Let me explain.

Yes, the Chronos aspect of decision-making is incredibly important. We must

have great analysis, the ability and will to make decisions in the moment, and

the courage to say either yes or no. Kairos

on the other hand implies a much more strategic view of time. In other words,

it fits exactly into what I have been arguing for the last 25 years: that we

need to make decisions over time. To be a great investor, we have to

inject some appreciation for Kairos

into our decision-making process. Saving a tick or two in Chronos mode can help, but only if it doesn't introduce regrettable

results on a more Kairos time frame.

A focus on making the right long-term decisions by implementing a suitable

decision-making horizon is so much more important than snagging a small

discount in haste.

One of the infamous sayings in the

bond business is, "There's always another bond coming down the tracks."

Thinking in Kairos mode allows us to think strategically. It gives us a more holistic view of our portfolio, and ultimately of our organization. Instead of trying to grab the one really cheap asset that we are being shown right this minute, Kairos appreciation gives us the ability to think longer-term. It also gives us the incredible ability to simultaneously consider multiple scenarios: rates down, rates unchanged, and rates up, for instance. Scenarios that aren't about now, but about future chronological time—Kairos. We might even have the patience to consider extreme scenarios, to identify what would have to happen for the investment to go terribly wrong. Wouldn't that be prudent?

So, am I saying that we should only employ Kairos-mode decision making?

The short answer is no, but my explication may take some

developing.

It is my firmly held belief that we need to be strategizing

and planning, over time, for our

portfolios. The decision whether to play offense (greater reward in rates down)

or defense (less pain in rates up) with the portfolio is both a portfolio and

an institutional decision. This should be determined thoughtfully, and once

decided, it can help us focus on the relevant areas of the market we need. This

is a process in which a group of people, like an investment committee or a board,

can and probably should have input. It will most likely be influenced by not

only the collection of securities that you already own but also by the

characteristics of the rest of your balance sheet, your operational needs, and

so forth. When done well, the result is a strategic plan under which you can

operate on a day-to-day basis with more efficiency. This Kairos mode thinking should inform and improve your real-time Chronos-mode decision-making.

So, while Kairos

is critical, it is not your only valuable approach to time. Once a strategic outline

has been set, we will need to switch to our best Chronos mode. This is when technical expertise comes into

play. When it is time to make a

decision, we need to be spot-on with our analytics. Be ready to ask questions

and call out weaknesses in any analysis you are provided by others, especially

counter-parties. With the appropriate confidence that comes from all the prior Kairos mode effort, you might just snap

up a 32nd or two—safely.

Combining these two ways of thinking about time can give us a very powerful framework for investing. If we succeed in combining the qualitative (Kairos) discipline with the technical accuracy (Chronos) discipline, we will be well on our way to becoming great investors.

Combining these two ways of thinking about time can give us

a very powerful framework for investing. If we succeed in combining the

qualitative (Kairos) discipline with

the technical accuracy (Chronos)

discipline, we will be well on our way to becoming great investors. Does this

mean that we will not make mistakes? Of course not, but these same two

disciplines can help us identify and hopefully eliminate the ones we have made

and minimize those we intend to make in the future.

Final, final

thought: Snow always seems cute and beautiful in the fall when the first

snowflakes fall, but enough already—let's get to spring. To our friends in

Texas and across the southern region: We wish a speedy recovery to you and your

neighbors.

Be sure to fill out the form below to subscribe to my weekly blog.