Talking politics around the holidays is almost never a good idea—especially lately. However, I keep hearing about the idea that all, or a great majority of, student debt will be forgiven. Whatever your politics may be on this issue, for capital markets participants, there is potentially also a serious financial consideration.

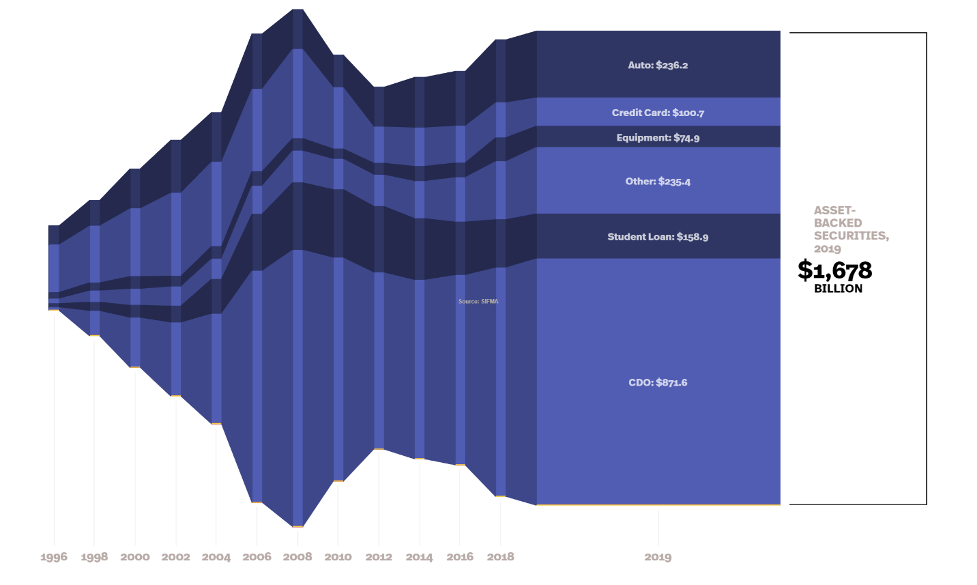

As I mentioned in my previous post, SIFMA publishes tons of great info about outstanding debt, so I checked out the makeup of the asset backed securities, and was amazed to learn that there is almost $160 billion outstanding in bonds backed by student loans. Can the government really just wipe that out? It seems implausible, not impossible, but I'm hardly an expert in this sphere, so instead I decided to tap someone here—Tim McCrary, who has been working with us at Performance Trust since 2012 and for most of that time, has been engaged in the student loan space on a daily basis. He is an extremely popular speaker at our Advanced Courses and is regularly featured on our Level Playing Field calls. Given his expertise on the topic, you can imagine how thankful I was that he made himself available for this interview.

(Kurt) There has been a lot in the news recently about possible

student debt relief or cancellation. Before we get into what Congress or the

Biden administration is looking to do in the future, what has the government already

done this year to give student loan borrowers relief?

(Tim) To understand what Congress has already done, it's important

to make a distinction between the Federal Direct Lending Program (FDLP) and the

Federal Family Education Loan Program (FFELP). FDLP loans are owned by the government

and are originated directly with borrowers. These loans have been owned by the federal

government since they were originated and remain so today. FFELP loans, on the

other hand, were originated by third parties and are owned by private

investors. The FFELP started in the mid 1960s and ended in 2010, when it was

replaced by the FDLP in an attempt to save costs by cutting out the private

intermediaries. Because the FDLP has been in place since 2010, the majority of

outstanding student debt now falls under that program. To give some context,

there is roughly $1.6 trillion of outstanding student debt in America today,

and $1.3 trillion of that is in the FDLP loans. The remaining $300 billion is largely

in FFELP loans ($160 billion of which is securitized, as Kurt already

mentioned), with a small percentage being completely private student loans

(originated and owned by the private sector with no guarantee from the

government).

So with that background, let's look at what Congress has

already done. A portion of the CARES Act that was passed in March suspended

principal and interest payments on federally held student loans. While the

majority of student loan borrowers in America were eligible for this relief

(because the majority of outstanding student debt was originated under the FDLP

and as a result is owned by the government), loans in FFELP bond deals were not

eligible, as these loans are held privately by the trust and only reinsured by

the DOE, meaning they are not federally held student loans. This relief was later

extended to December, but consistent with the original law, it still did not

include the FFELP loans that are in bond deals. FFELP borrowers did get some

relief throughdisaster forbearance. This allowed

borrowers to suspend payments for around three months and waived interest

during that time. When the pandemic hit hard in the US, the situation was

classified as a national emergency and all borrowers were given the option of taking

disaster forbearance. That three-month period has since concluded and has not -

not yet at least - been renewed. It's worth noting that this disaster

forbearance did not suspend interest payments coming into FFELP bonds as the

DOE subsidizes loan holders with Special Allowance Payments (SAP), but it did slow

prepayment speeds for the near term.

So that's what the government has

done so far. What has been proposed for the future?

Many have put their support behind student debt

forgiveness over the last few years. Back in May of 2019, we did a breakout theme

on the LPF webinar in which we discussed debt forgiveness plans proposed by then-Democratic

Presidential candidates Bernie Sanders and Elizabeth Warren. These ideas were

relatively important parts of these candidates' policy platforms at the time,

but they lost momentum in the mainstream media when Joe Biden secured the

nomination. Over this past summer and fall, a number of proposals for further

economic stimulus included some form of student debt forgiveness, but none were

passed into law.

Now that the election has passed, and the country

prepares for a new administration in the White House, the jockeying for support

for a wide array of policy programs is going full force. Student debt relief is

no exception. Most notably, Elizabeth Warren and Chuck Schumer have called on

the incoming Biden administration to issue an executive order that would

forgive $50,000 of student debt per person, without any vote on the plan from Congress.

The Biden transition team has not shown support for this specific policy, and

there's question as to whether or not it's even legal, but earlier when a bill advanced

by House Democrats proposed forgiving $10,000 of student loan debt per borrower,

Mr. Biden showed support for the idea by saying it "should be done

immediately". Of course, that was in the middle of a campaign. Today, there are

numerous proposals being circulated concerning student debt forgiveness and

relief, and it's not useful here to go through all of them. The point is that

there is political momentum on the issue, especially among leaders of the

Democratic Party in both the legislative and executive branches.

If student debt were forgiven, how would it affect FFELP

bonds?

First, forgiving FFELP loans will likely be more

difficult for federal government to push through than would be forgiving the FDLP

loans that they own. We saw this difference in March, when it came to payment

relief. That said, politically, it's understandably difficult to tell certain borrowers

they get relief while others don't, as both groups took the government option

available to them at the time they needed money.

So let's assume debt forgiveness does become law and this

includes the FFELP loans underlying FFELP bonds. Previous proposals have designated

revenue sources with which to pay for this debt relief. For example, Elizabeth

Warren proposed a tax on individuals above a certain level of net worth, and

Bernie Sanders suggested a tax on all equity and fixed income trades. If there

is a dedicated revenue source associated with the debt relief, current holders would

presumably be paid back for any debt that is forgiven, especially if the

legality of the government's authority to outright forgive that debt is in

question. In the event that debt forgiveness passes and lenders (and hence, bondholders)

are repaid at par, overall, this would be a positive for the FFELP sector investors,

as the majority of these bonds trade at discount dollar prices (some are at

small premiums).

But what if debt is forgiven but not repaid to lenders at

par, and instead all the underlying loans in the securitized FFELP deals are

treated as defaults? While this could, and almost certainly would, lead to

legal battles between FFELP loan holders and investors in the subordinate

tranches of FFELP deals, most senior tranches would likely take no losses.

Let's run through why. Remember, FFELP loans are guaranteed

at a minimum rate of 97% of their outstanding principal balance, first by a third-party

guarantee agency and then this is reinsured by the Department of Education, this

latter being an explicit guarantee from a department of the federal government.

While this guarantee represents the lion's share of FFELP bonds' principal

protection, senior tranches also have credit enhancement. In most deals, senior

tranches enjoy the buffers of a combination of subordinate tranches,

overcollateralization, and reserves in the trust. These are all subordinate to the

senior tranches and take losses before them, which helps protect the senior

bonds from the risk of loss even if defaults rise significantly.

The last major consideration for FFELP Floater Bonds from

a principal protection standpoint is a concept called 'claim rejections'. In

unique circumstances, the Department of Education (DOE) may reject a guarantee

agency's reimbursement claim on a defaulted loan if the loan was originated or

serviced in a negligent or improper way. The occurrence of claim rejections is

very low, roughly 0.10-0.20% per period, for all submitted claims. Despite

being so low, it's worth mentioning because as I noted above, the 97% or more

guarantee on FFELP loans is the main bulwark of principal protection for the

bonds. Aside from net claim rejections, at least 97% of the balances for FFELP

loans are insured by the DOE, whose failure to honor their guarantee would be

analogous to guarantees not being honored on GNMA or SBA bonds. When we

consider these factors, even when running credit stress cases on FFELP Floaters,

assuming for the purpose meaningfully higher than ever observed default rates

and claim rejections, we have yet to see a senior FFELP floater take a loss

under these stresses.

To summarize

There is political momentum for broad-based student debt forgiveness from both Congress and President-Elect Biden, but whether this is enough to overcome broad-based popular resistance to the idea in many quarters remains to be seen. The legality of the government forgiving privately-owned FFELP loans is questionable, but even if it were permitted, and even if such forgiveness did not come with repayment to lenders from the federal government but rather resulted in the default of all FFELP loans, these senior tranches in FFELP bonds are unlikely to take losses. This is because the loans are guaranteed at 97% or more of their principal balance and senior bonds have credit enhancement greater than 3% in nearly every circumstance. Because these bonds are unlikely to take losses and largely trade at discount or small premium dollar prices, debt forgiveness would likely be an overall positive for investors in FFELP (assuming attractive alternative investments are available for the pay-off proceeds).

I want to once again thank Tim for his time.If you have more specific or more in-depth questions for Tim, he can be reached at tmccrary@performancetrust.com

Final, final thought: I'm not a huge chocolate fan and would probably never eat a peppermint stick…so why do I love peppermint bark so much?

Be sure to fill out the form below to subscribe to my weekly blog.