What a weekend we just had here in Chicago, except for the

Bears' loss to the Titans! In an almost unprecedented stretch of weather, it has

been over 70 degrees for seven days in a row, and this looks likely to continue

for a few days more.

It was great for me, because I was able to sit outdoors in

the moderate sunlight while studying up on the history of the U.S. Senate. Some

of you might scratch your head and wonder why I wasn't instead walking my dogs

or riding a bike, but my fellow introverts (editor's note: yeah, right!) will

understand that there is nothing quite like historical study to make a perfect day.

I also had a very critical business rationale for studying this particular history,

because I think the outcome of the two Georgia run-offs in January will largely

set the tone of business and government for the medium to longer term of

investing. In the medium term, there is

nothing better for business than gridlock in Washington. Sure, a stimulus bill might

give a quick jolt (like a double espresso does), but for a really high-quality

business environment, what we really crave is stability and a lack of change.

That does seem strange, doesn't it?

I'm going out on a limb here, but in some ways, there is a

parallel to the second law of thermodynamics, namely the concept of entropy.

This is a very loose definition, but stick with me for a minute and I think it

will make sense. The rule states that isolated systems (analog: our two-party political

system) will spontaneously evolve towards a state of thermodynamic equilibrium

(analog: the political center). This point of "maximized" entropy requires the

least energy to maintain it. Politically, the most positive results are found

when we rest in this "neutral" state. Less conflict, less friction, less

destruction.Needing less energy to

maintain an extreme structure, more energy can be spent on

positive/constructive results. A divided government in many ways represents

this kind of balanced state.

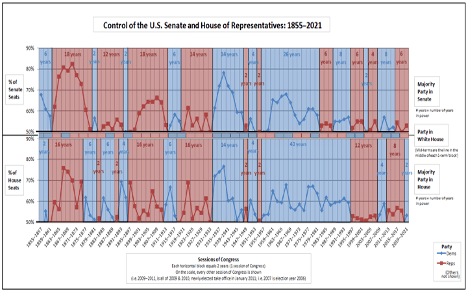

Check out this graphic from the United States government

archives. The top section of the graph shows us, by color, the party

controlling the Senate (the line shows by how much) and the bottom section

shows the same for the House of Representatives (the Presidency is indicated by

the narrow band between them). It's kind of amazing to think that back in the 1930s

and 1940s, 80% of the Senate was democratic! Think about that. I had also been

unaware that from 1957, Democrats controlled the House for 40 straight years! It's

really only been during my own professional career, since the mid-90s, that political

power has been pretty balanced, see-sawing narrowly around an even split.

But, at the end of the day, the brakes against hectic in

either direction has always come down to the Senate. Presidents have their

agendas, the House can get really excitable, but the Senate is actually

designed to go slow.

Think about the incredible foresight (some would say luck!)

of the founding fathers in establishing this form of government. Having checks

and balances, which among other things foster the peaceful transition of power,

has contributed significantly over the years to the incredible constructive

power of the United States. Having the Senate be the buffer between the sometimes-mercurial

House of Representatives and the personal ambitions of the Presidency was

brilliance.

I'm pretty sure Madison, et al.didn't consult the Second Law of Thermodynamics while formulating the Constitution, but knowingly or not they created a system that moves (sometimes quickly, sometimes slowly) towards a sort of "entropic" equilibrium.

Vaccines

I am not a virologist, but boy, I am frustrated with this

pandemic. I'm tired of having to make every decision about whether or not I

have to put on a face mask or not. Face masks are emblematic of how doing

anything has been made very tiresome by this virus. We have not seen movement

towards any kind entropic equilibrium, and so it is exhausting.

Happily, though, some great news has just been released by

Pfizer. Here is the short version:

By Robert Langreth, Naomi Kresge and Riley Griffin

(Bloomberg) -- The Covid-19 vaccine being developed by Pfizer Inc. and BioNTech SE prevented more than 90% of infections in a study of tens of thousands of volunteers, the most encouraging scientific advance so far in the battle against the coronavirus. Eight months into the worst pandemic in a century, the preliminary results pave the way for the companies to seek an emergency-use authorization from regulators if further research shows the shot is also safe.

The findings are based on an interim analysis conducted after 94 participants, split between those who got a placebo and those who were vaccinated, contracted Covid-19. The trial will continue until 164 cases have occurred. If the data hold up and a key safety readout Pfizer expects in about a week also looks good, it could mean that the world has a vital new tool to control a pandemic that has killed more than 1.2 million people worldwide.

"This is about the best the news could possibly be for the world and for the United States and for public health," said William Gruber, Pfizer senior vice president for vaccine clinical research and development. It was better than even the best result he had hoped for, he said. With effectiveness for the first vaccines previously expected to be in the range of 60% to 70%, "more than 90% is extraordinary," BioNTech Chief Executive Officer Ugur Sahin said.

'Victory of Science'

"It shows that Covid-19 can be controlled," Sahin said in an interview. "At the end of the day, it's really a victory of science."

By the time you have read this, it will be all over the

news but I was so happy when I woke up this morning to the news to see that

such significant progress had been made. Let's keep our fingers crossed. I'm

sure it will get politicized, different factions will want the credit, but at

this point, I don't really care: let's just rid of this virus!

10-Year Treasuries

I have talked about this at some length in the past, so I

will keep it brief today. Rates up is possible.

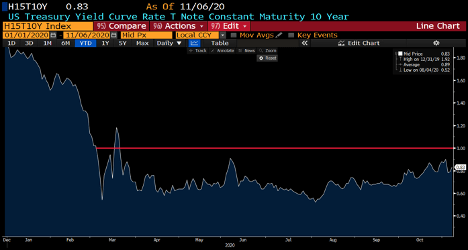

I am including a chart of the 10-year constant maturity

Treasury. As you can see, since the pandemic really started kicking in around mid-March,

the rates have been pretty steady between 0.60% and 0.90%. These rates would

have been unthinkable just a couple years back, but now they are just commonly

accepted.

In my last post, I discussed that selling cheap options

(also known as teenies) is verboten

in the options industry.Such positions

are almost impossible to hedge, given their extreme Gamma risk. They have finished

off many a lazy option trader through the years. Unfortunately, the steady

drumbeat of very low rates has encouraged the widespread selling of these very options

on an almost unprecedented scale. Investors have been selling their souls (in

the form of short option positions) for a mere 10, 15, or 20 basis points.

Maturities have extended, call dates have shortened. This cannot end well for

those involved, well, except for the local FHLB or other quasi-government agencies

who have been on the other side. Think about the extreme price volatility on a 10-year,

non-call 6 month even if rates merely return to where they were at the

beginning of 2020. Not to be dramatic, but you are looking at losses in the 10%

range or worse. For those who prefer to talk dollars, that is a loss of

$100,000 or more for every million invested.

The warning has been issued. As always, no one knows what

will happen to rates, but the danger is real. It's math and, should rates return to pre-pandemic levels, the pain

would at that point be unavoidable, for a few basis points in income and a

surrendered upside potential in rates down. Ugh.

Final, final thought: We usually get around 300 trick or treaters. This year, we only had 96 which has left me with a lot of extra candy. The risk of my personal "up 100" scenario may have nothing to do with interest rates!